Is Nvidia defining the future of power electronics?

A recent article by Junko Yoshida for the Yole Group describes how Nvidia, a company that doesn’t design or make power devices, is defining the features and functions of tomorrow’s power electronics in moving to a 800V high-voltage direct current (HVDC) data centre power infrastructure

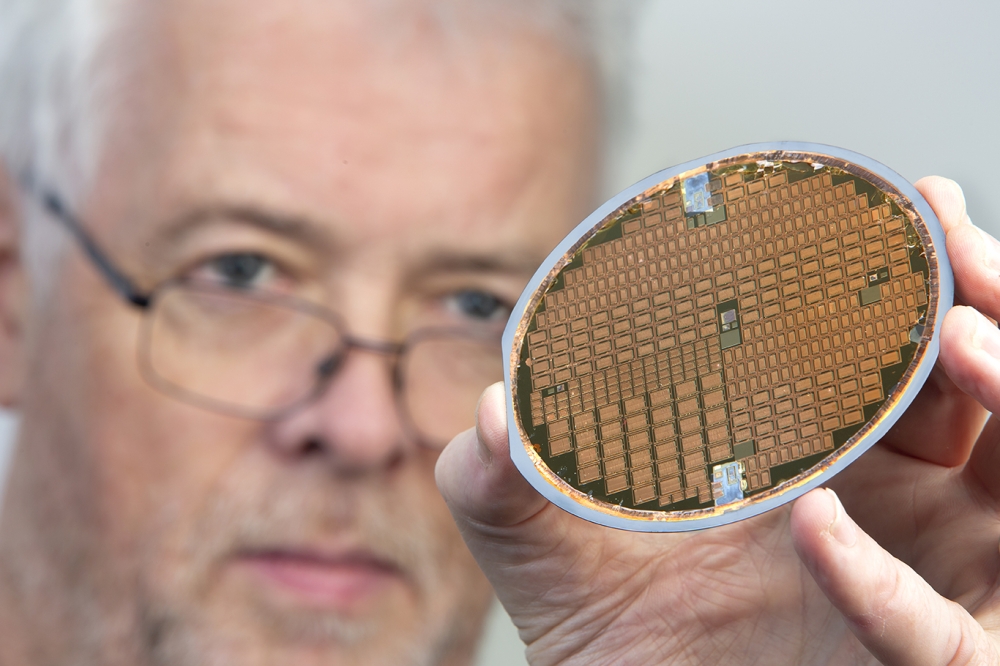

Yoshida's article describes the company as creating momentum behind GaN as like a 'Tesla moment for SiC'. And just as STMicroelectronics reaped the fruits of Tesla’s early push for SiC, 'Infineon and Navitas are jockeying to profit from the emerging GaN moment driven by Nvidia'.

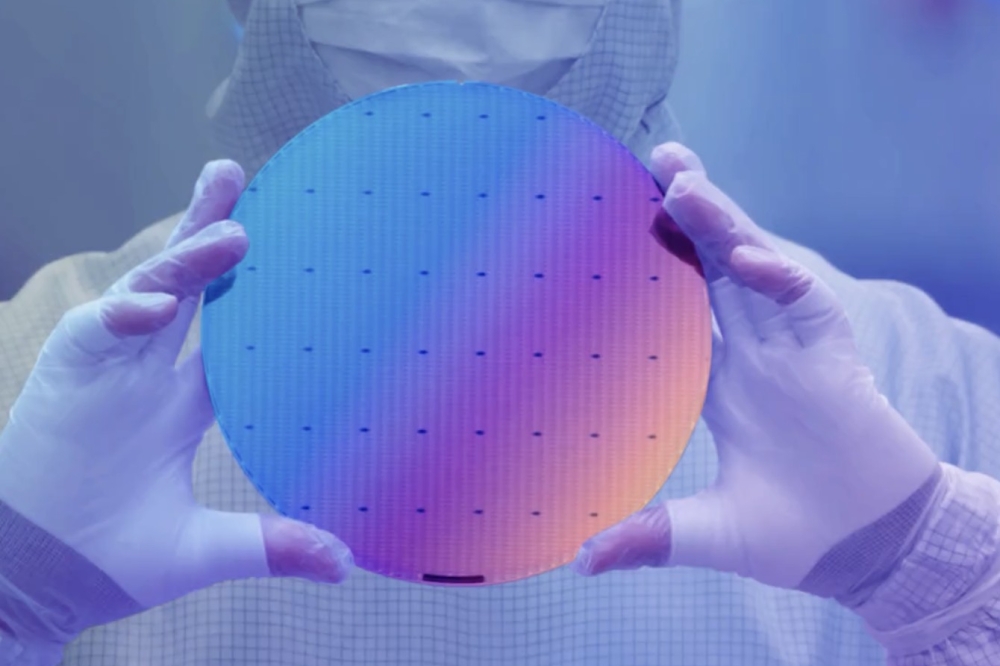

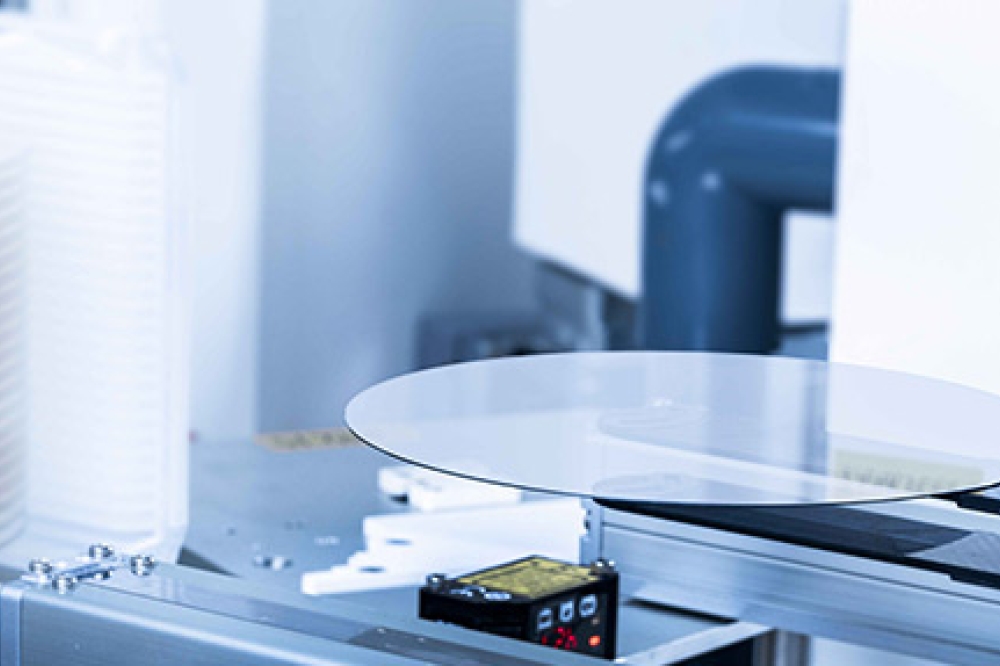

Many suppliers of Wide Bandgap (WBG) semiconductors and silicon vendors are playing along, willing to invest in new technologies to deliver what Nvidia needs, writes Yoshida.

In the piece, Gerald Deboy, head of the System Innovation Group at Infineon Technologies, compared Nvidia to a maestro, orchestrating “the entire world to architect a new way of building and operating data centres.”

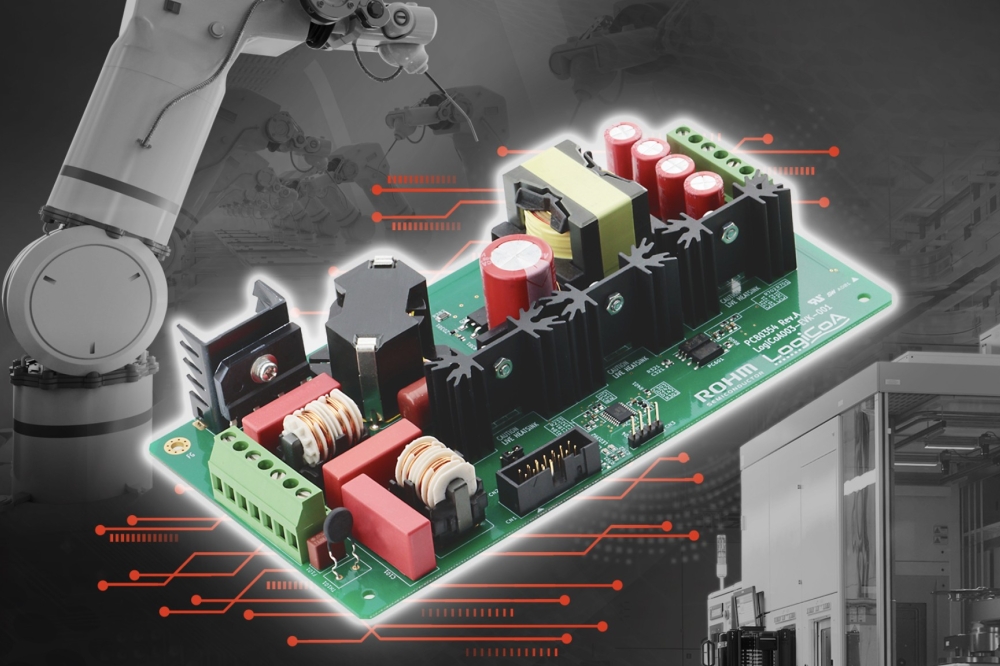

Those enlisted by Nvidia include Infineon, MPS, Navitas, Rohm, STMicroelectronics, and Texas Instruments. Also in the mix are suppliers of power system components such as Delta, Flex Power, Lead Wealth, LiteOn, Megmee, and companies who build data centre systems, including Eaton, Schneider Electric and Vertiv.

Hassan Cheaito, market and technology analyst in power electronics at Yole Group, sees Nvidia’s push for AI data centres is creating momentum behind GaN as like a “Tesla moment for SiC.”

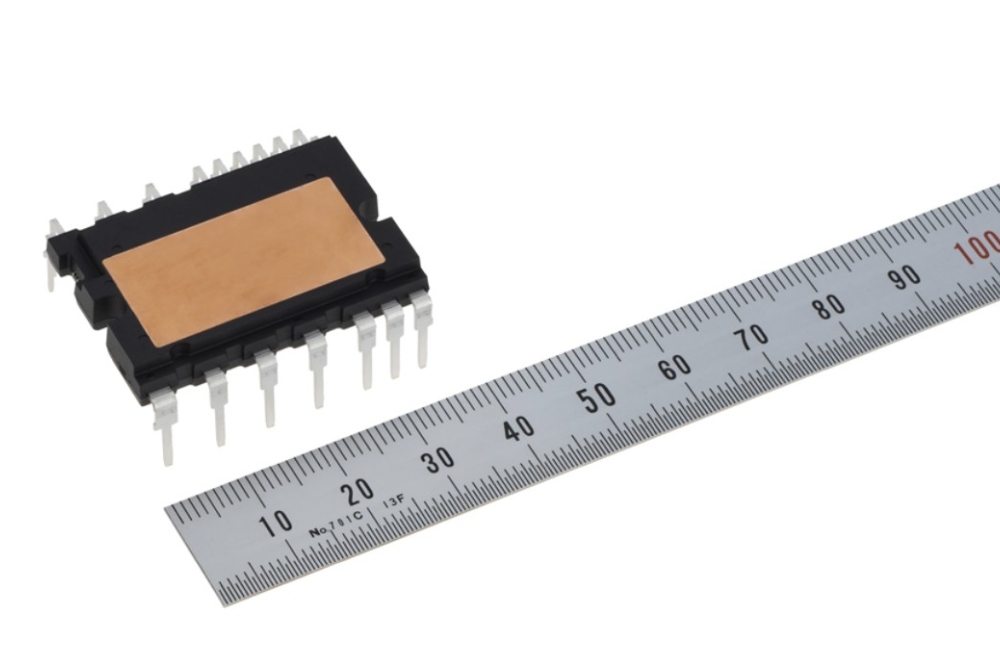

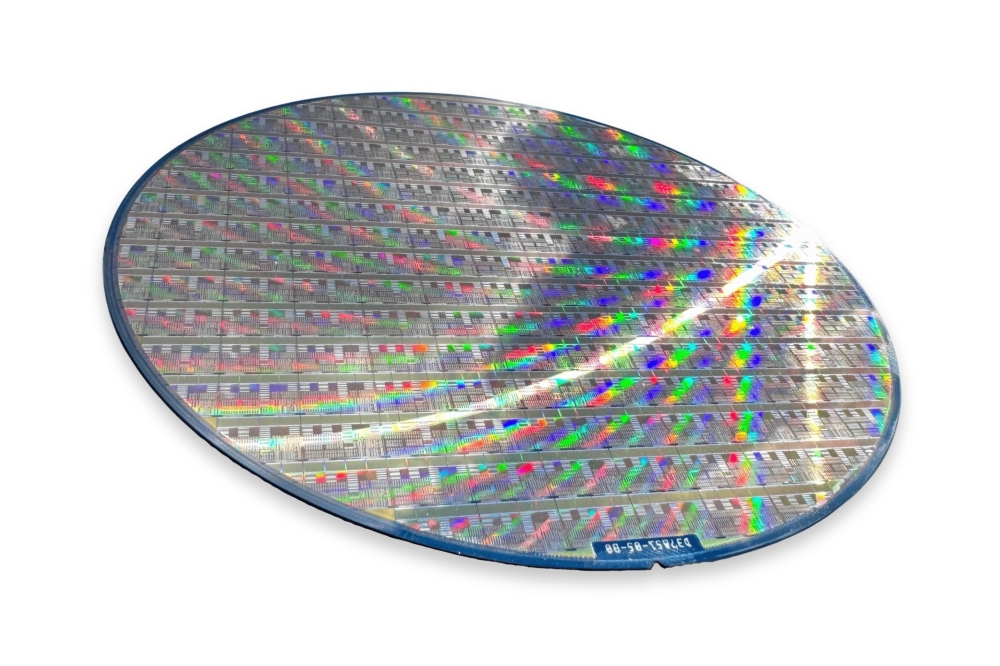

A range of new power devices and semiconductors will be needed for the new HVDC data centre architecture.

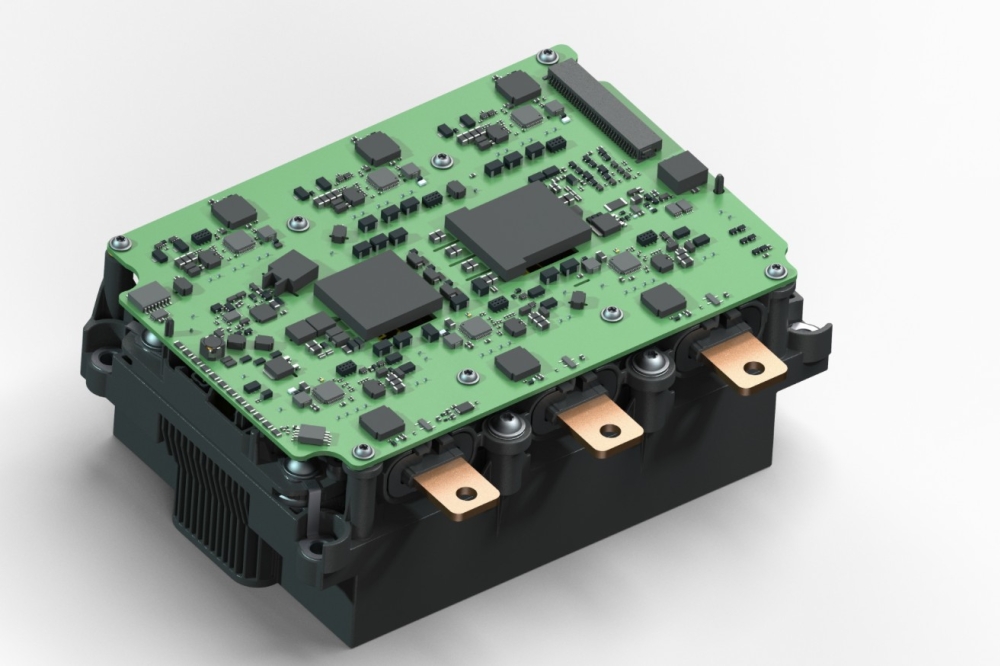

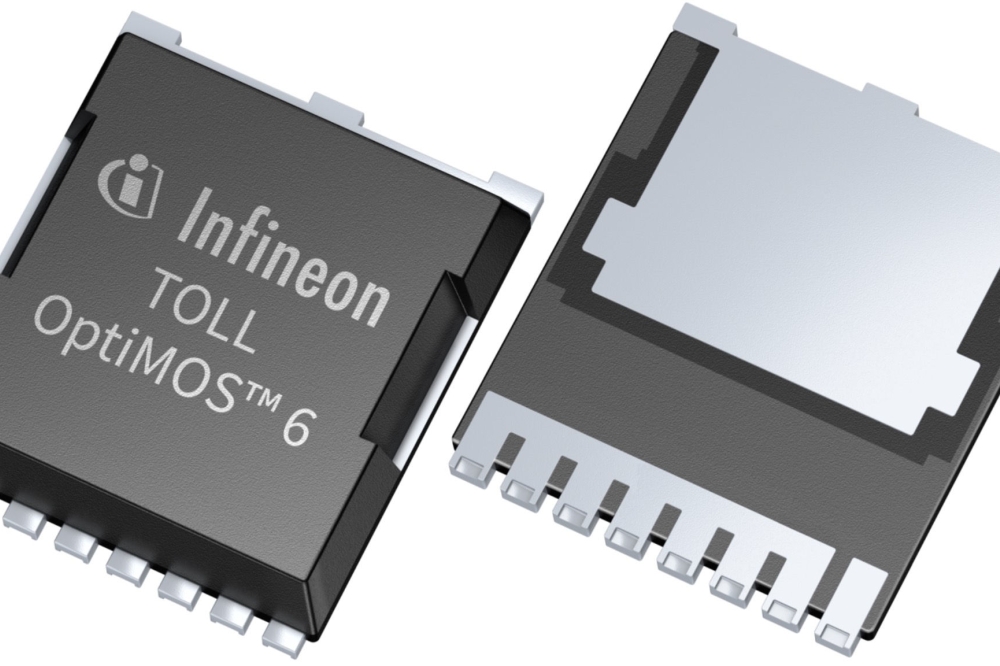

According to Infineon’s Deboy, for data centre power infrastructure that needs high-power, high-voltage solutions, SiC leads. But for conversion from 800 to 50V, space restraints dictate high-switching frequency. This makes it “more of a GaN domain,” he added. Meanwhile, for conversion from 54V to 6V, in so-called low voltage intermediate bus converters (IBC), both GaN and silicon are okay.

800V AI data centres also demand new semiconductor-based relays, explained Deboy. In data centres today, AC is distributed in three phases, with a normal relay and a normal switch turning power on and off like a light switch. In contrast, in a new high-voltage DC AI data centre, Deboy said that safety requires “new semiconductor components that control over currents and inrush currents in a very well-maintained behavior.”

Taken all together, Poshun Chiu, principal technology and market analyst at Yole Group tabbed Infineon as “by far the leader in power electronics.” When AI data centres ask for a hybrid power electronics solution, noted Chiu, Infineon’s strength shines in all three fields, ranging from SiC to GaN and Si semiconductors. Infineon, added Chiu, covers every phase of the power chain in AI data centres, striving to offer the best technology fit for each stage.

Infineon, however, isn’t alone in racing to capture Nvidia-driven AI data centre opportunities. Gene Sheridan, CEO of Navitas Semiconductor notes in the article, “As you get closer to the processor, Nvidia gets more hands on.” Starting at 48 volts, Nvidia is driving design, component selection and supplier selection, he said. “We’re working with them every week…on evaluations, characterisations, benchmark testing, prototyping, to help Nvidia figure out that final solution.”

Navitas is taking advantage of its strength in GaN to address power electronics solutions required by AI data centres. The acquisition of GeneSiC Semiconductor in 2022 has also helped Navitas bolster its wideband gap portfolio.

Beyond GaN or SiC, useful for traditional AC to DC converters, or 800V DC to DC converters, Navitas also dabbles in “48V down to power the processor,” which is closest to the processor.

Sheridan finds a new opportunity triggered by the industry’s highest voltage SiC technology, which his company obtained via its GeneSiC acquisition. Ultra-high-voltage SiC technology will be essential in developing “solid state transformers” connected to the grid. Beyond data centres, Sheridan believes grids are getting upgraded to solid-state transformers everywhere, powering cities and homes, even connecting to renewable energy.

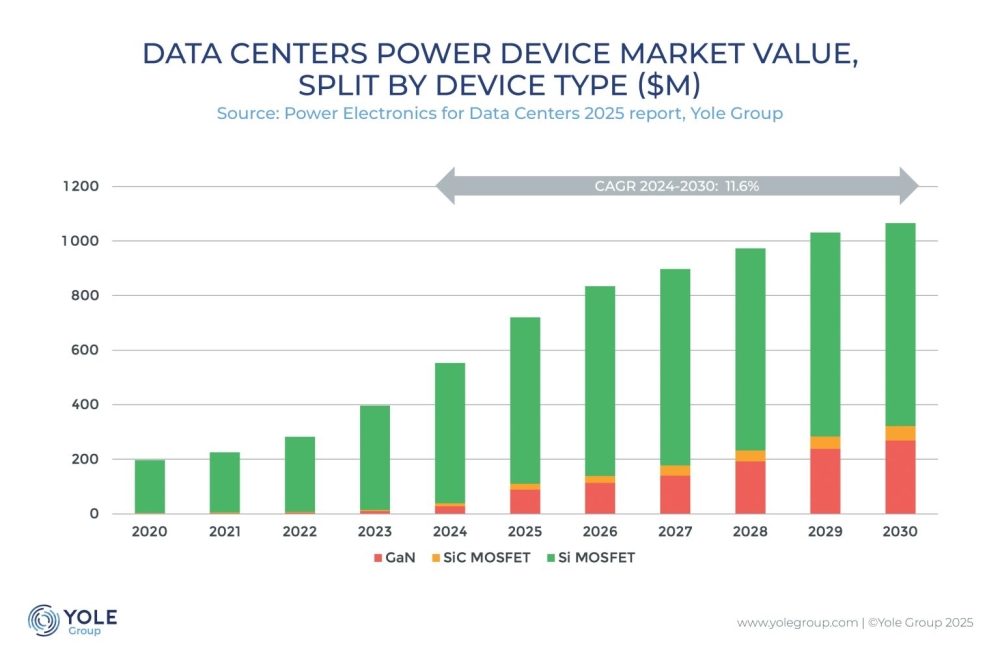

In the AI data centre market, Yole Group predicts that GaN will outgrow SiC. While SiC is focused on AC to DC, GaN used in DC to DC can also enter AC to DC. This is because GaN devices pose the potential for higher voltage, explained Chiu. “Although we see some upside market for SiC, about $100 million in three to five years, the opportunity seems much bigger for GaN.”