Industry eyes integrated magnetics for AI chips

With power-hungry AI chips on the rise, Apple, Intel and others are turning to magnetics-on-silicon, pioneered by Ireland’s Tyndall National Institute, to dramatically raise energy efficiency.

By Rebecca Pool, Technical writer, PEW Magazine

The filing follows a series of applications relating to integrated magnetics on silicon spanning eight years, with listed inventors including Apple engineers as well as Professor Cian O’Mathuna, Director of Integrated Power and Energy Systems Research, and colleagues, at Ireland’s Tyndall National Institute.

Such patent activity stems from nearly three-decades’ worth of research on integrated magnetics at Tyndall, and comes at a time when the likes of Nvidia, AMD, Google and Intel are rolling out the hungriest of AI chips. Packed with hundreds of thousands - or more - processing units, vast on-chip memory and advanced interconnects, these chips easily eat up hundreds of watts, and then some, for massive parallel computations.

So how can integrating magnetics onto silicon chips help? It’s largely about minimising the footprint and energy losses of DC-DC power supplies.

Breakthroughs in both magnetic thin films on silicon and PCB-embedded magnetics have enabled the miniaturization of magnetic inductors that can replace bulky, wire-wound magnetic components. As O’Mathuna puts it: “For me, the best way to get the ultimate miniaturisation was always with integrated magnetics and magnetics-on-silicon technology.”

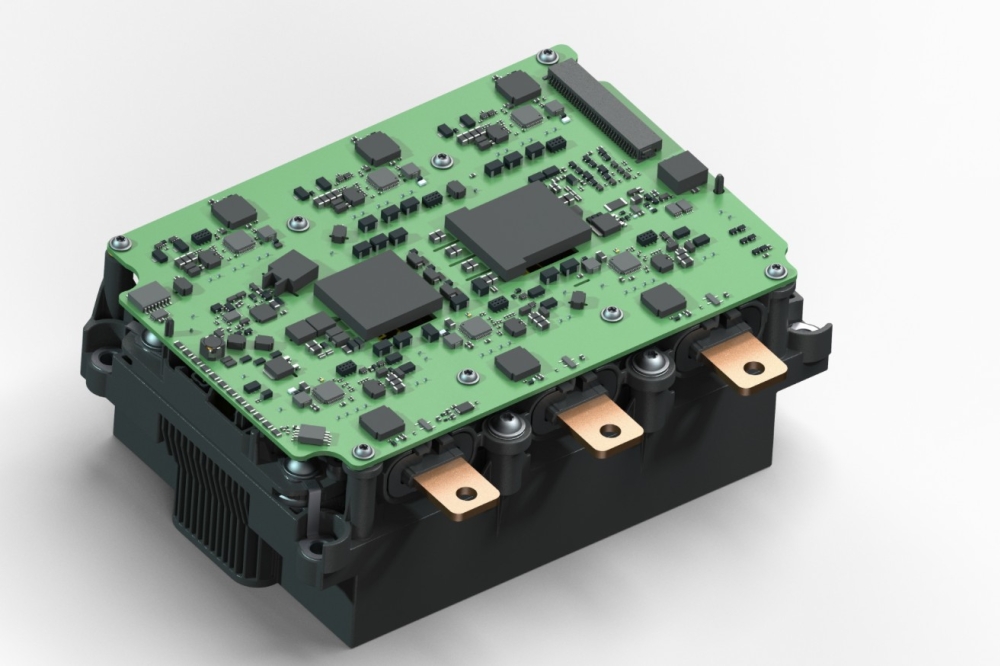

Smaller inductors can be integrated, alongside power management ICs (PMICs ) and capacitors, onto a single chip, forming an advanced integrated voltage regulator or DC-DC converter. This serves as the final stage in the power supply system for a processor, and can be placed underneath the processor chip, either in the package substrate or embedded in the interposer, in a vertical configuration. Vertically integrating the power supply with the processor chip minimises parasitic losses and provides a faster transient response, dramatically enhancing the efficiency of power delivery. Critically, a large array of power supplies can deliver fast, efficient granular power, from directly beneath the compute die.

“When we build the inductor on silicon, we can make it really really small - we would even say we make the magnetics disappear onto the silicon chip, which is why we call this technology MagIC. We also have an array of inductors associated with an array of DC to DC converters,” says O’Mathuna. “So now I can control the current going into each core or each part of the processor, while minimising interconnect losses.”

The Tyndall Director also believes an integrated magnetics approach makes manufacturing sense for the AI chips of tomorrow. “We’re introducing a new component but not a new manufacturing technology per se, as the magnetic disc-head industry has been using this type of technology for thirty years,” he points out. “So this is not a massive leap of faith.”

Indeed, integrated magnetics have already found their way into commercial chips, as part of a vertical power delivery set-up, to enable high performance computing. Intel, for one, has integrated coaxial magnetic composite core inductors to its processor chips. Meanwhile Apple uses magnetic thin-film inductor technology from TSMC. In late 2021, the tech-giant released its MacPro computers with an array of 140 integrated, thin-film coupled inductors fabricated on five silicon PMICs, which delivered vertical power to the processor, through the package substrate and interposer. According to reports, this integrated magnetics technology enabled Apple’s MacPro to last for 18 hours from a single battery charge, compared with between 6 to 9 hours for previous models. “We do hold a patent with Apple in this space,” confirms O’Mathuna.

Reaching out

At the start of this year, O’Mathuna and Tyndall colleagues were also granted a patent for a novel thin-film vertical inductor, again designed to boost power efficiency in AI applications. In the coming year, they will be working on proof-of-concept studies and then intend to licence the associated technology to Tyndall industry partners. This is an extension of their ongoing industry activities - various integrated magnetics technologies have already been licenced to multiple international companies.

While all license deals are confidential, Tyndall has published the results of collaborative research with many international companies including Global Foundries, Infineon, Intel, Murata (formerly IPDIA), Taiyo Yuden, Texas Instruments and Wurth Electronics. O’Mathuna highlights the Global Foundries silicon-based Ultimate Miniature Magnetic Inductors and Transformers (SUMMIT) platform. As part of this, 3mm² solenoid-type inductors and transformers can be monolithically integrated onto silicon substrates for power supply on chip (PwrSoC) DC/DC or integrated voltage regulator applications for AI accelerators and other high-performance computing systems.

“Wurth Elektronic [Germany] has also been designing its own inductors, with fabrication through an external foundry, with some really impressive results,” he adds.

Along the way, chip inductor firms, including Taiyo Yuden, as well as Murata and TDK have also been developing their own high temperature magnetic materials for compact and very low profile PCB-embedded magnetics. For example, Taiyo Yuden’s LSCN series of multilayer power inductors has a thickness of only 0.2 to 0.3 mm, which according to O’Mathuna, meets the demands of high-end PCB suppliers, such as AT&S, Austria, keen to embed components in the circuit board.

“You could imagine these companies saying; ‘So what can we do to stay competitive here - Intel is using soft magnetic composites in PCBs – could we put our inductors into the PCB? Yes we can but they need to be very thin,’” he says.

Other industry players, including Atlas Magnetics, Empower Semiconductor, Ferric and Texas Instruments, have taken a different approach, and have been manufacturing entire PMIC modules, (Power Supply in Package – PsiP), which include integrated magnetics. These modules typically include a small ASIC with multiple DC to DC converters and inductors, have a very low profile of some 0.6 mm, and are assembled using conventional surface mount assembly technology.

O’Mathuna highlights how Ferric, for one, manufactures a multi-phase output module and had previously been working with TSMC on thin film magnetics - but has since moved onto an alternative, undisclosed technology. “These companies set out to fit within the existing surface mount assembly supply chain and so developed PSiP modules,” points out O’Mathuna.

“It’s pretty cool to see how [these companies] can get the power management, magnetics and possibly capacitors all into 0.6 mm thickness,” he says. “This indicates that there is a lot of innovative routes to creating integrated inductor solutions.”

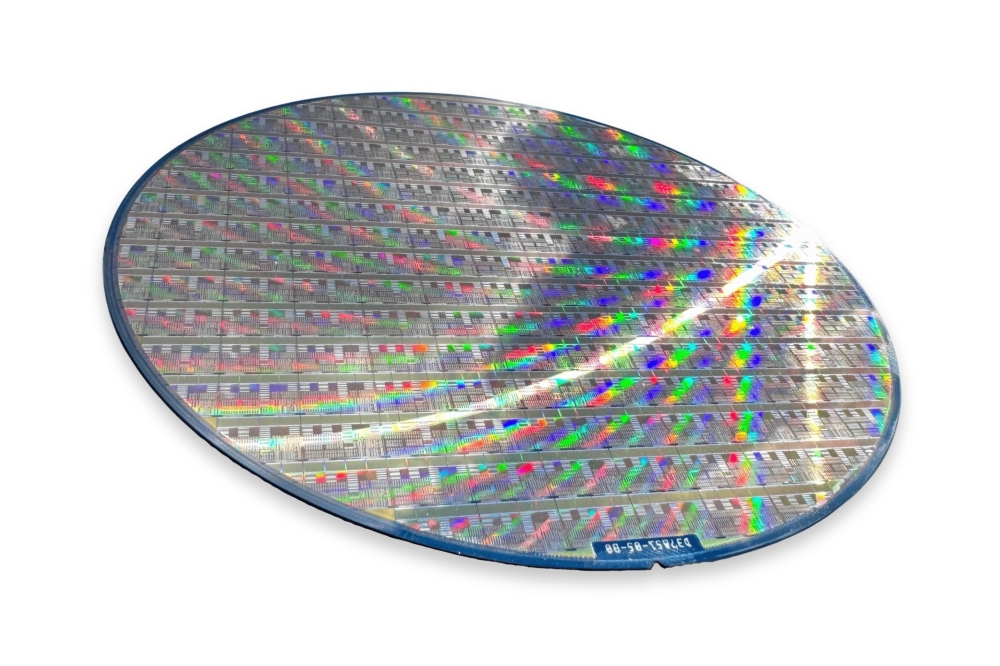

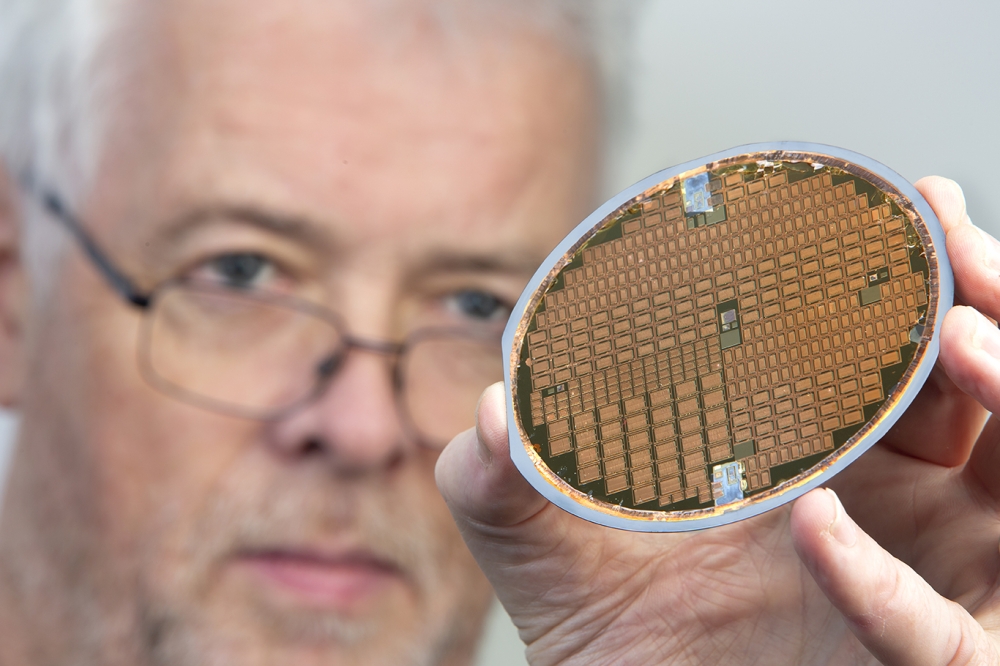

Integrated magnetic chips fabricated at the Tyndall Institute. [Tyndall]

Commercial moves

As more and more of their developments edge closer to commercialisation, Tyndall researchers continue to work with myriad magnetic materials. For example, as part of their magnetics-on-silicon development, they currently deposit thin films of cobalt-based and Fe-based alloys on silicon as well as cobalt-based thin magnetic films on vertical copper structures.

To drive magnetics-on-silicon fabrication forward, Tyndall researchers are currently part of the EU-funded FD-SOI FAMES Pilot Line, funded under the Chips for Europe initiative. With project partners CEA-LETI, in Grenoble, the researchers are developing a miniaturised DC-DC converter in which a PMIC and thin-film inductor will be flip-chipped or micro-transfer printed onto a high density trench capacitor interposer substrate. “For granular power, you could have a number of these chiplets in an array, so you can deliver power to multiple loads in a processor,” says O’Mathuna.

Apple processors developed by TSMC already have high density trench capacitors attached to the interposer. “With the Apple product, TSMC has demonstrated that it can put the magnetics on top of the silicon PMIC,” says O’Mathuna. “So I would suggest that the commercial application of FAMES technology, is not a million miles away – it could be three to five years away.”

O’Mathuna also highlights how global firms began to show significant interest in Tyndall’s magnetic-on-silicon technology more than a decade ago, prompting him and colleagues to start working on technology transfer.

“These companies had various levels of success in taking the technology forward – this isn’t an easy thing to do,” he says. “But now TSMC and Global Foundries have magnetics-on-silicon technology, it’s going to be much easier for the industry to progress.”

“You could say that after thirty years of research, magnetics-on-silicon has become an overnight success,” he adds.

Supply chain complexities

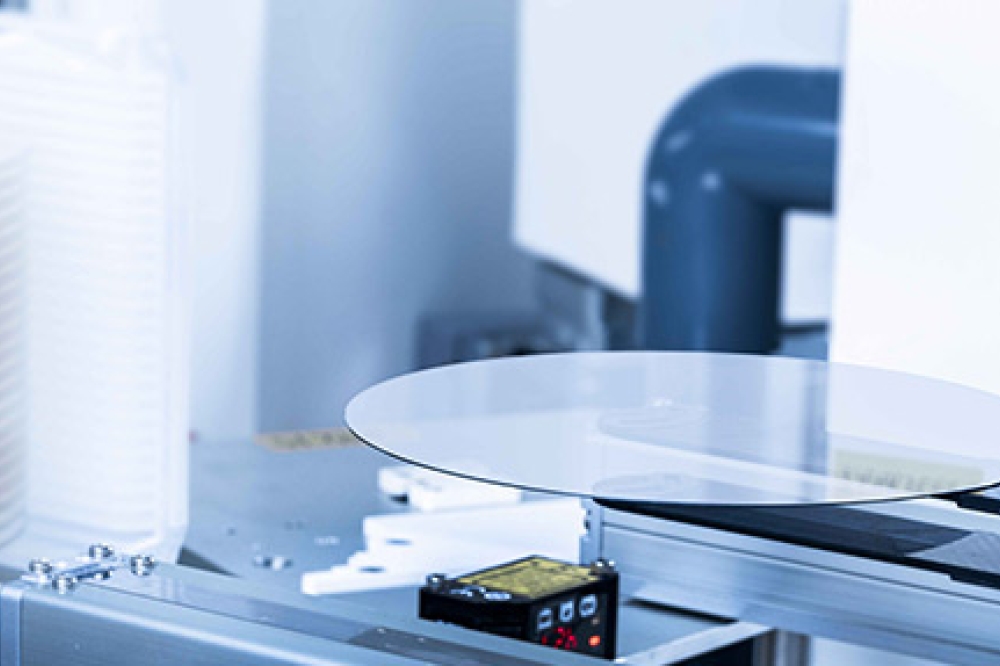

But is the integrated magnetic supply chain ready for commercial-scale manufacturing? Not quite yet. Right now, only a handful of firms are operating in the integrated magnetics-on-silicon, PCB-embedded magnetics, and PMIC/magnetics modules spaces. For example, only two industry players appear to be offering magnetic-on-silicon technology right now; TSMC in volume production and Global Foundries, which is currently sampling to customers.

O’Mathuna is well aware of the supply chain complexities that lie ahead, highlighting how magnetic components have yet to be built into the CAD EDA tools used by IC designers. “There is work to be done here... and who should be working on it? Should it be, say, TSMC?” he asks. “Or could the OSATs (Outsourced Semiconductor Assembly and Test) vendors do this? They take the wafers from companies and package them, so this could give them a significant competitive advantage to add integrated power delivery to their capabilities.”

He also points to Intel’s involvement in PCB embedded soft magnetic composites, and wonders if the technology is Intel-specific and therefore proprietary. “Even PCB embedding of chip inductors becomes complicated as you now have a package substrate but need to talk to the Taiyo Yudens of the world and ask them to work with a package substrate supplier on embedding the chip inductors,” he says. “We’ve got a complexity here that needs to be worked out in terms of who owns what, who’s going to be responsible for reliability issues that may arise in manufacture and whose problem is it?”

Yet despite the complexities, O’Mathuna is optimistic that given recent industry developments, supply chain issues will be ironed out in the near-term. Reiterating how TSMC has Apple as its customer for magnetic thin-film inductor technology while Wurth Electronik’s interest in the technology can only drive business for the foundries, he asserts: “The future of integrated power is about making magnetics disappear.”

“All of these power companies are trying to get into the AI chiplet space and AI power delivery, and from a sustainability point of view you could save dramatic amounts of energy if you adopt a vertical power approach,” he says. “Some AI companies have said, we can do the power management chips but our problem is the magnetics... This is the bottleneck, which means there’s a big opportunity here.”

Main image : Professor Cian O’Mathuna is Director of Integrated Power and Energy Systems Research at Ireland’s Tyndall National Institute. [Tyndall]