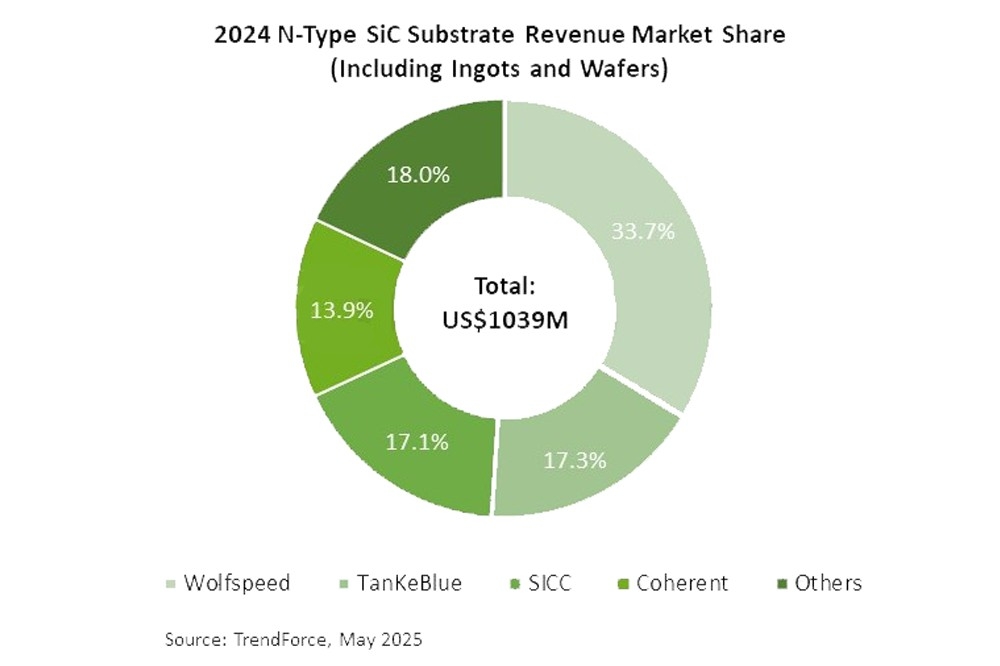

SiC substrate revenue down 9% in 2024

TrendForce’s latest research shows that weakening demand in the automotive and industrial sectors has slowed shipment growth for SiC substrates in 2024. At the same time, intensifying market competition and sharp price declines have pushed global revenue for n-type SiC substrates down 9 percent YoY to $1.04 billion.

Looking ahead to 2025, the SiC substrate market will continue to face dual pressures of soft demand and oversupply. However, long-term growth prospects remain promising. As production costs gradually decline and semiconductor device technology advances, SiC applications are expected to expand—particularly in diverse industrial segments. Moreover, heightened competition is accelerating industry consolidation and reshaping the market landscape.

Four major players control 82 percent market share; Wolfspeed remains the leader

Wolfspeed maintained its position as the top supplier in 2024 with a 33.7 percent market share, despite ongoing operational challenges. The company remains a key force in the SiC materials market and continues to lead the industry’s transition to 8-inch wafers

Chinese vendors TanKeBlue and SICC have rapidly emerged as major players, claiming 17.3 percent and 17.1 percent market shares respectively, placing them in second and third place. TanKeBlue is the largest domestic SiC substrate supplier for China’s power electronics market, while SICC leads in the 8-inch SiC wafer segment. Coherent, by contrast, dropped to fourth place with a share of 13.9 percent.

Although 6-inch SiC substrates will remain dominant in the near term—due to their steep price declines and the technical challenges of scaling 8-inch front-end processes—8-inch wafers are seen as essential for further cost reduction and advancing chip performance. This is driving aggressive investment across the industry.

TrendForce forecasts that 8-inch SiC substrates will account for over 20 percent of total shipments by 2030, signalling a pivotal shift in the technology roadmap.