SiC slowdown is only short term, says Yole

Despite a temporary slowdown in BEV shipments, the SiC market remains on a long-term growth trajectory, according to the Yole Group.

Its analysts forecast the power SiC market will exceed $10 billion by 2029, driven by a strong rebound in 2026 with CAGR between 2024 and 2023 close to 20 percent.

"SiC adoption has accelerated since 2018–2019, primarily led by Tesla, the early disruptor in automotive electrification. In 2024, Tesla continued to dominate the SiC-based BEV segment with nearly two million units shipped, although that figure is down 5 percent from 2023, " said Poshun Chiu, senior technology and market analyst at Yole Group.

Meanwhile, other OEMs, especially from China, are gaining ground. BYD, Nio, Geely, and Xiaomi are expanding their SiC-based BEV portfolios.

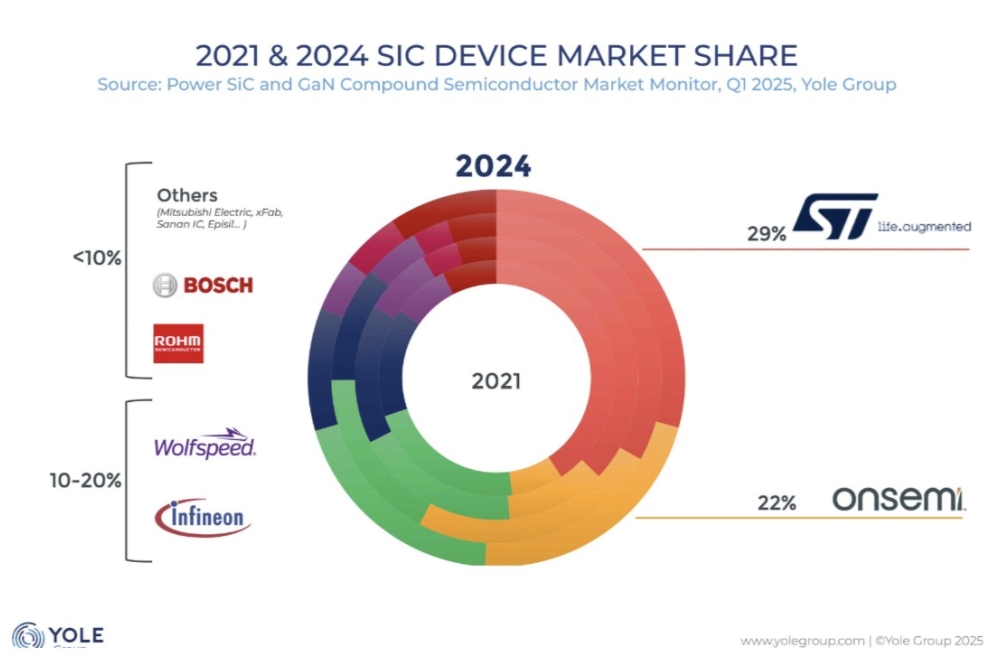

Despite these positive trends, the overall market deceleration has impacted the revenue growth of key SiC suppliers such as STMicroelectronics and onsemi, though Infineon Technologies continues to grow, supported by its diversified applications across both automotive and industrial sectors.

While many players are expanding capacity, especially in transitioning from 6-inch to 8-inch wafers, current end-system demand may not yet justify this scale.

Ezgi Dogmus, activity manager, Compound Semiconductors at Yole Group says: "Industry feedback suggests that total announced capacity could outpace short-term SiC device consumption. Suppliers are now adjusting production volumes on a per-order basis and slowing down some expansion plans to match market realities for 2024 and 2025."

Key factors to monitor include wafer quality, yield, and supply chain efficiency. As competition intensifies, vertical integration becomes more critical. Leading companies, including STMicroelectronics, onsemi, Wolfspeed, and Infineon Technologies, are doubling down on internal wafer manufacturing and module production to meet their billion-dollar revenue targets.

Yole Group identifies STMicroelectronics’ approach as one of the most ambitious moves among non-Chinese semiconductor players. Faced with rising competition and China’s push for local sourcing, the leading semiconductor company has adopted a unique “become Chinese in China” strategy.

Yole Group’s analysts spotlight three key partnerships underpinning this approach: a $3.2 billion joint venture with Sanan Optoelectronics for SiC devices, a manufacturing collaboration with Hua Hong Semiconductor for 40nm automotive MCUs, and a strategic investment in GaN leader Innoscience. These moves are designed to localise production, support Chinese OEMs, and secure long-term market share in China’s EV and industrial sectors.

This detailed analysis, based on the Power SiC/GaN Compound Semiconductor Market Monitor, Q1 2025, suggests that these bold moves could significantly boost STMicroelectronics’ growth from 2026 while also shaping the competitive landscape in SiC markets.

Yole says although the short-term outlook has cooled, analysts remain confident in SiC’s long-term momentum, especially as BEV demand recovers and industrial applications continue to expand.