Worries about Wolfspeed as a 'going-concern'

US SiC giant Wolfspeed has announced results for Q3 2025, with shares tumbling nearly 25 percent due to concerns for the company’s long-term survival.

Q3 2025 revenue was $185m, as compared to $201m in Q3 2024. The Mohawk Valley Fab contributed $78m in revenue compared to $28m in Q3 24. Gross margin was -12 percent (11 percent in Q3 24). GAAP loss per share was -$1.86 ( - $1.18 in Q3 22).

While the top-line figures don’t seem too bad, the company is struggling with $6.5b of debt obligations. And – as it said in the regulatory filing – “there is substantial doubt about the company’s ability to continue as a going concern as of the issuance date, in accordance with the requirements of ASC 205-40.”

Wolfspeed is waiting on $750 million in federal funding under the US CHIPS Act. In March 2025, President Donald Trump said US lawmakers should get rid of the law and use the proceeds to pay debt.

Meanwhile, Wolfspeed's customers are dealing with tariff-induced uncertainty, with General Motors trimming its 2025 profit forecast, while Mercedes-Benz had pulled its earnings outlook for 2025, according to Reuters.

TrendForce’s latest research shows that weakening demand in the automotive and industrial sectors slowed shipment growth for SiC substrates in 2024, with global revenue for n-type SiC substrates down 9 percent YoY.

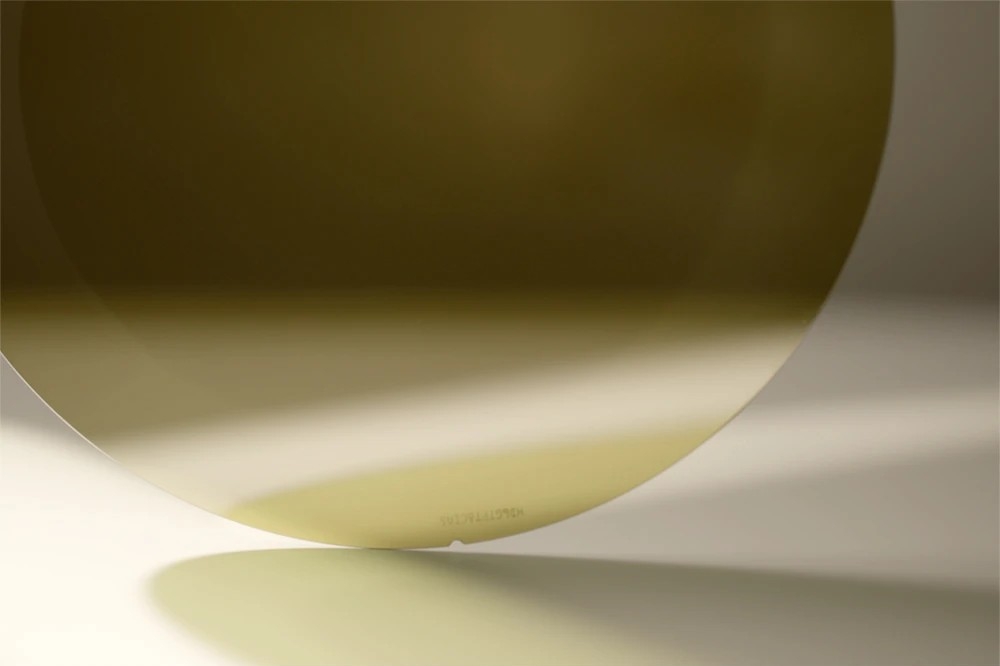

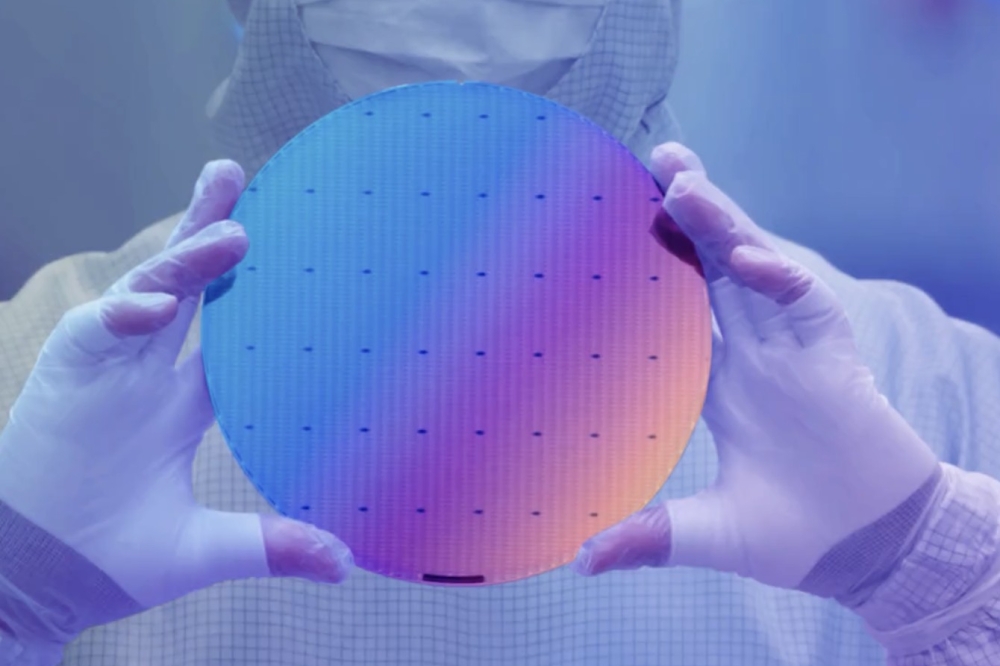

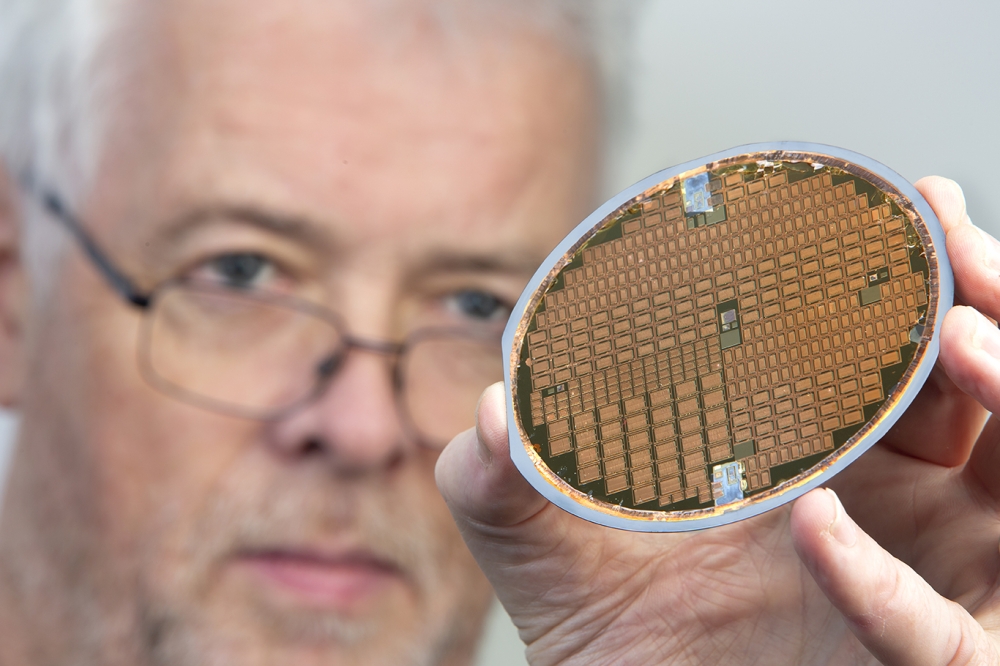

Despite the decline, TrendForce says long-term SiC demand remains strong as the 8-inch (200-mm) roadmap gains momentum. Wolfspeed leads the SiC substrate market with 33.7 percent market share in 2024 and is leading the transition to 8-inch wafers. Chinese vendors TanKeBlue and SICC have 17.3 percent and 17.1 percent market shares respectively, placing them in second and third place. Coherent, by contrast, dropped to fourth place with a share of 13.9 percent.

Wolfspeed says its current operating forecast over the next 12 months will allow it to maintain operations and meet its obligations to customers, vendors and employees in the ordinary course of business. It has engaged external advisors Paul Walsh and Mark Jensen to the board to assist with strategic alternatives, including capital restructuring.

Walsh most recently served as CFO and SVP, Finance and Administration of Allegro Microsystems. He previously served as CFO of Rocket Software and held multiple finance roles at Silicon Laboratories, ultimately serving as SVP and CFO. He currently serves on the boards of Kopin Corporation and Semtech Corporation.

Jensen brings an extensive background in finance and accounting, having most recently served as US managing partner, Technology Industry, at Deloitte from 2001 to 2012. Before joining Deloitte, he held senior roles as CFO of Redleaf Group and managing partner at Arthur Andersen. Jensen currently serves on the boards of 23andMe and Lattice Semiconductor.

Tom Werner, chairman of the board of Wolfspeed said: “At the beginning of the year, the company outlined a plan focused on strengthening our capital structure, improving our path to profitability, and raising cost effective capital to support our growth plan. I’m pleased to report that the board and management have made significant progress against all of the priorities we outlined – completing our $200m ATM offering, receiving $192m of our Section 48D cash tax refunds, simplifying the business to focus on our pure-play 200-mm capabilities and accelerating our path to cash flow breakeven, and hiring Robert Feurle [pictured above] as Wolfspeed’s new CEO."

“Most importantly, we continue to work closely with our lenders on ways to address our capital structure so that Wolfspeed has a strong financial foundation to support its continued success.”

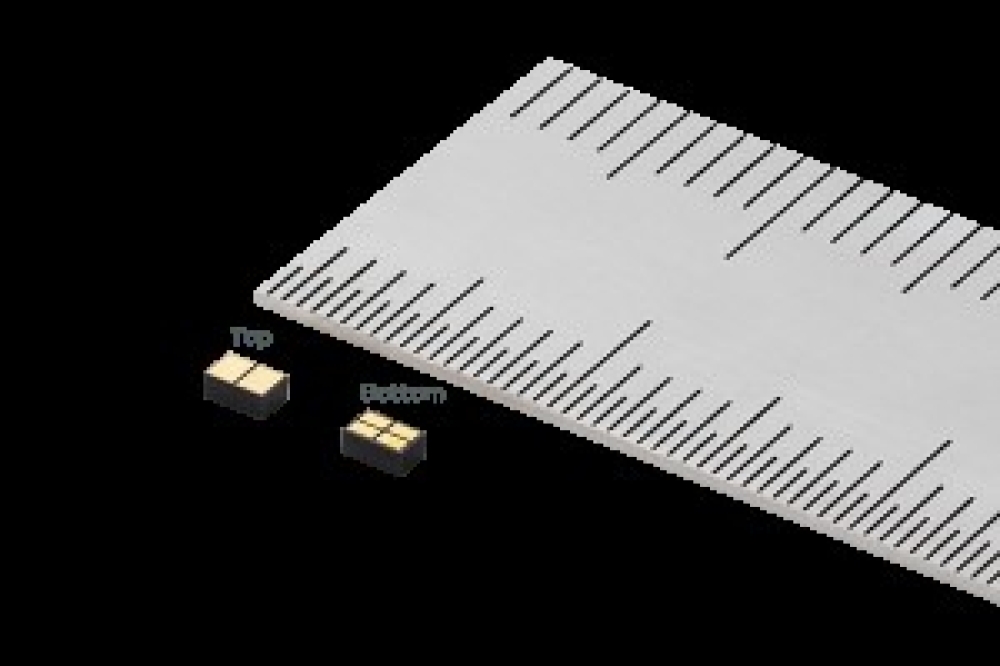

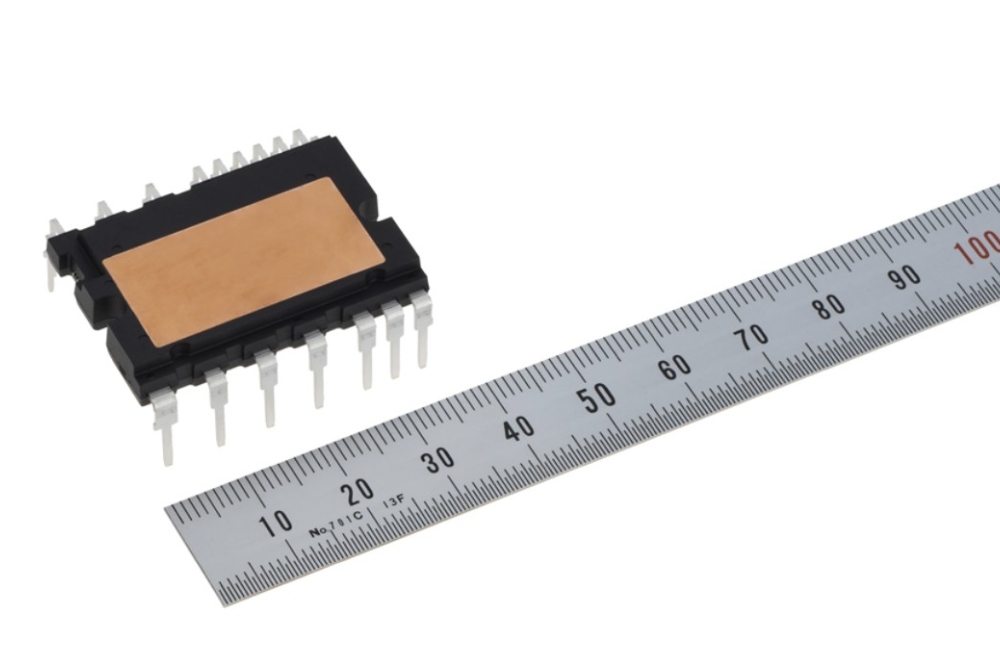

Feurle, added, “One of the key drivers in my decision to join the company was Wolfspeed’s enormous potential, underpinned by strong foundational elements. The company's SiC technology is second to none and the company has already established a greenfield, best-in-class, fully automated 200mm manufacturing footprint to provide next-gen solutions to our customers. I am aligning the organisation to drive innovation across the business and in key strategic verticals that demand quality, reliability, and efficiency – precisely where our purpose-built 200-mm platform sets us apart.”