Will Wolfspeed file for bankruptcy?

Facing competition from Chinese rivals and weak demand in industrial and automotive markets, Wolfspeed is preparing to file for Chapter 11 bankruptcy within weeks, according to the Wall Street Journal and Reuters.

Last week Compound Semiconductor highlighted Wolfspeed's “substantial doubt about the company’s ability to continue as a going concern as of the issuance date, in accordance with the requirements of ASC 205-40", which it wrote in recent regulatory filings.

Two months ago the company was exploring alternatives with regard to its convertible notes, and talking with lenders, including Apollo and Renesas. But it is believed that those talks have collapsed, and that the company has also turned down multiple out-of-court restructuring offers.

Weighed down by around $6.5 billion in debt, the US SiC giant is also grappling with ongoing tariff-related uncertainty — adding more pressure to an already strained business, writes TrendForce.

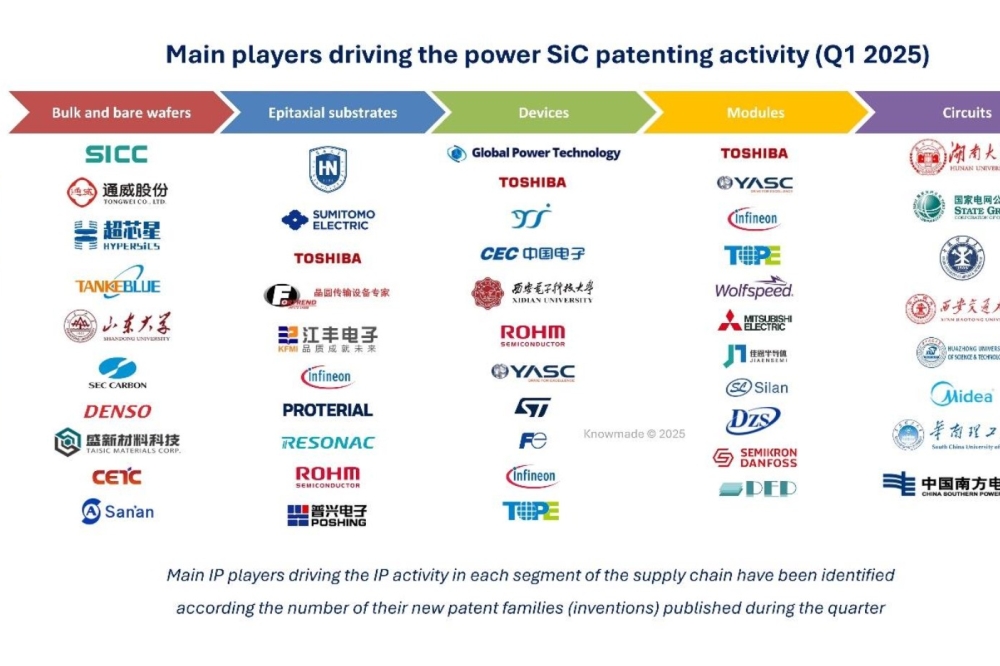

A February report from Nikkei highlighted China’s aggressive push into mature chips and niche substrates, driving prices to record lows. Wolfspeed’s 6-inch SiC wafers once sold for $1,500 each—now Chinese rivals are offering them for as little as $500 or less, the report added.

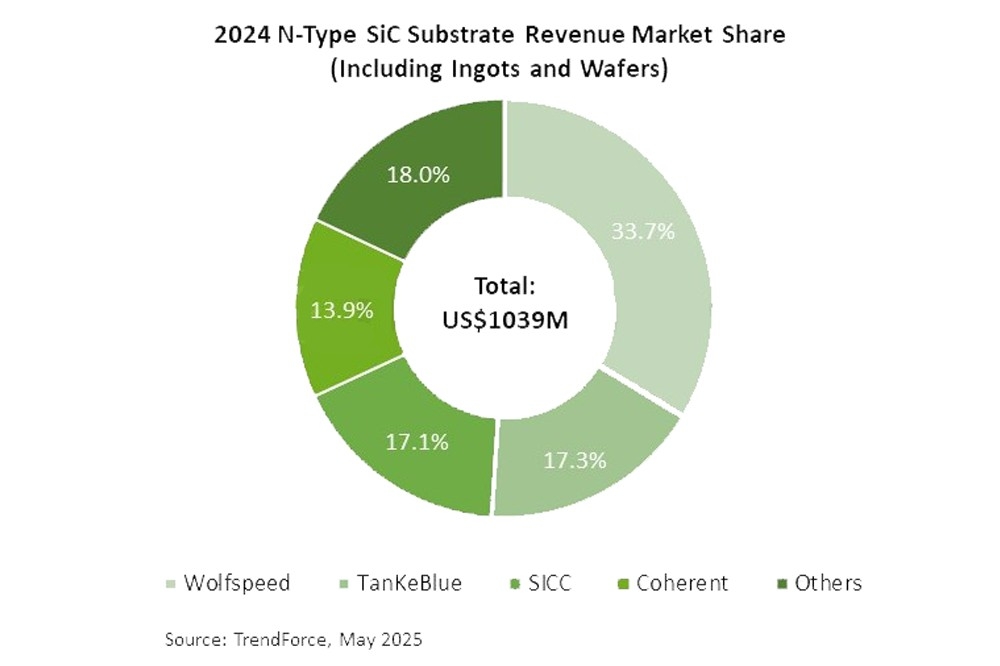

TrendForce’s latest research shows that in 2024, Wolfspeed held the top spot with a 33.7 percent share in the SiC substrate market. However, Chinese rivals TanKeBlue and SICC quickly rose, capturing 17.3 percent and 17.1 percent shares, securing second and third place.