News Article

Yole: Power to dominate GaN-on-Silicon market

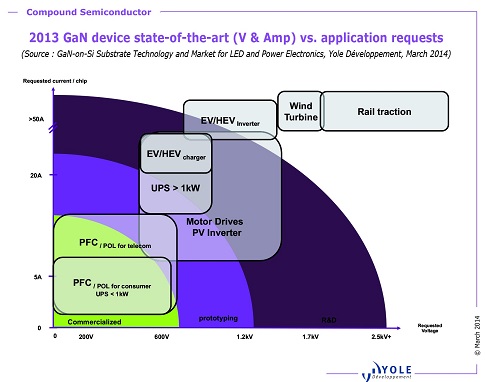

Yole believes GaN-on-silicon wafers are expected to capture more than 1.5 percent of the overall power substrate volume, This may suggest that 600V devices would take off in 2014 to 2015

Yole Développement is releasing, this week, the "GaN-on-Si Substrate Technology and Market for LED and Power Electronics" report.

Yole analysts Hong Lin and Eric Virey give an overview of the GaN-on-silicon epiwafer playground. The report also provides an analysis of GaN-on-silicon technology for LED and power electronic applications, including technology and cost aspects.

GaN-on-silicon enables GaN power electronics, will LED transition as well?

Yole Développement analysts believe that although LEDs will not capture much of the market for GaN-on-silicon technology, that it will be widely adopted by power electronics applications.

The power electronics market addresses applications such as AC to DC or DC to AC conversion, which is always associated with substantial energy losses that increase with higher power and operating frequencies.

Incumbent silicon based technology is reaching its limit and it is difficult to meet higher requirements.

GaN based power electronics have the potential to significantly improve efficiency at both high power and frequencies while reducing device complexity and weight. Power GaN are therefore emerging as a substitution to the silicon based technology. Today, Power GaN remains at its early stage and presents only a tiny part of the power electronics market.

"We are quite optimistic about the adoption of GaN-on-silicon technology for Power GaN devices. GaN-on-silicon technology have brought to market the first GaN devices. Contrary to the LED industry, where GaN-on-sapphire technology is main stream and presents a challenging target, GaN-on-silicon will dominate the GaN based power electronics market because of its lower cost and CMOS compatibility," says Eric Virey.

"Although GaN based devices remain more expensive than silicon based devices today, the overall cost of GaN devices for some applications are expected to be lower than silicon devices three years from now, according to some manufacturers. In our nominal case, GaN based devices could reach more than 7 percent of the overall power device market by 2020," he adds.

Yole believes GaN-on-silicon wafers are expected to capture more than 1.5 percent of the overall power substrate volume, representing more than 50 percent of the overall GaN-on-silicon wafer volume, subjecting to the hypothesis that the 600V devices would take off in 2014 to 2015.

GaN- on-silicon epiwafer: buy it or make it?

Which business will be dominated?

To adopt the GaN-on- silicon technology, device makers have the choice between buying epiwafers or templates on the open market, or buying MOCVD reactors and making epiwafer by themselves.

Today, there is a limited number of players selling either epiwafers or templates or both on the open market. These players comes from Japan, US and Europe. Yole has not observed an absolute dominance from one region.

As perceived by device markers, each business model has its pros & cons in terms of IP, technology dependence, R&D investments, and time.

According to Yole reports, analysts do not expect to see a significant template/epiwafer business emerge for LEDs and consider that LEDs makers would prefer making their epiwafers internally for mass production.

For the power electronics industry, the opinion is divided. Yole considers that buying epiwafers could work as long as the price of the epiwafer on the open market keeps decreasing.