$25b compound semi market by 2030

The compound semiconductor market is set to reach $25 billion by 2030 according to market research firm Yole's latest report, 'Status of the Compound Semiconductor Device Industry'.

While being only a small part of the $1 trillion semiconductor device market, compound semiconductors are "enablers", says Yole, driven by rapid growth in automotive, telecom, and mobile sectors.

Ezgi Dogmus, activity manager, compound semiconductors at Yole Group said: "The compound semiconductor device industry is on a rapid growth trajectory between 2024 and 2030, surging at an impressive CAGR of nearly 13 percent—outpacing the broader semiconductor market. This acceleration is fuelled by the booming automotive and mobility sectors, with strong momentum also coming from telecom, infrastructure, and consumer electronics."

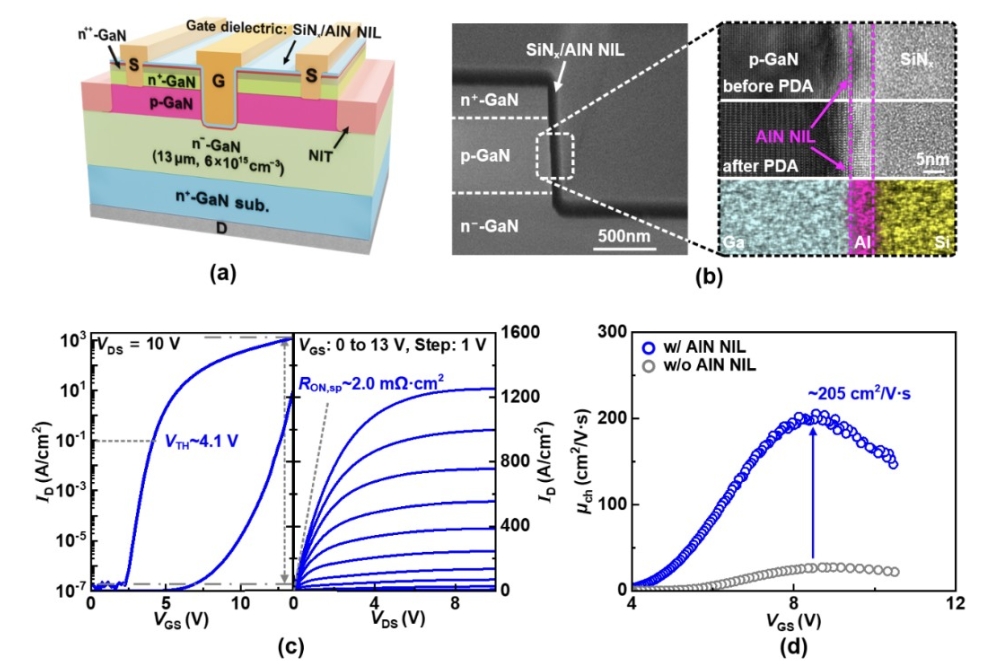

After SiC adoption, is GaN the next to watch?

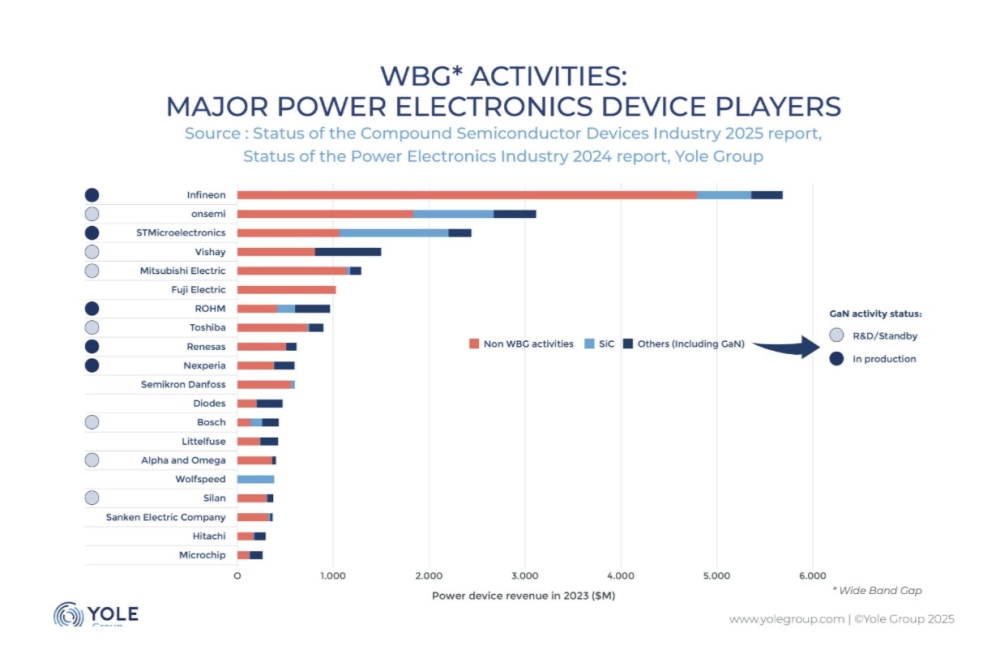

Over the past decade, a rapid push for power SiC adoption saw Wolfspeed divest its RF and LED businesses to concentrate on SiC. In parallel, STMicroelectronics, Onsemi, and Infineon Technologies expanded their SiC investments, adopting vertically integrated business models to reduce wafer supply dependencies amid geopolitical tensions.

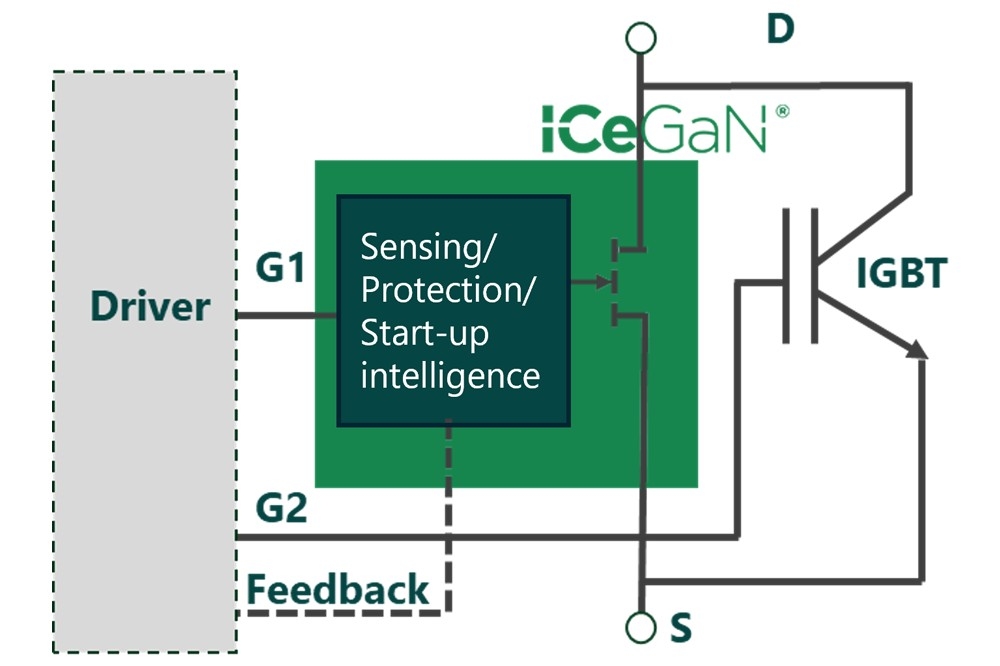

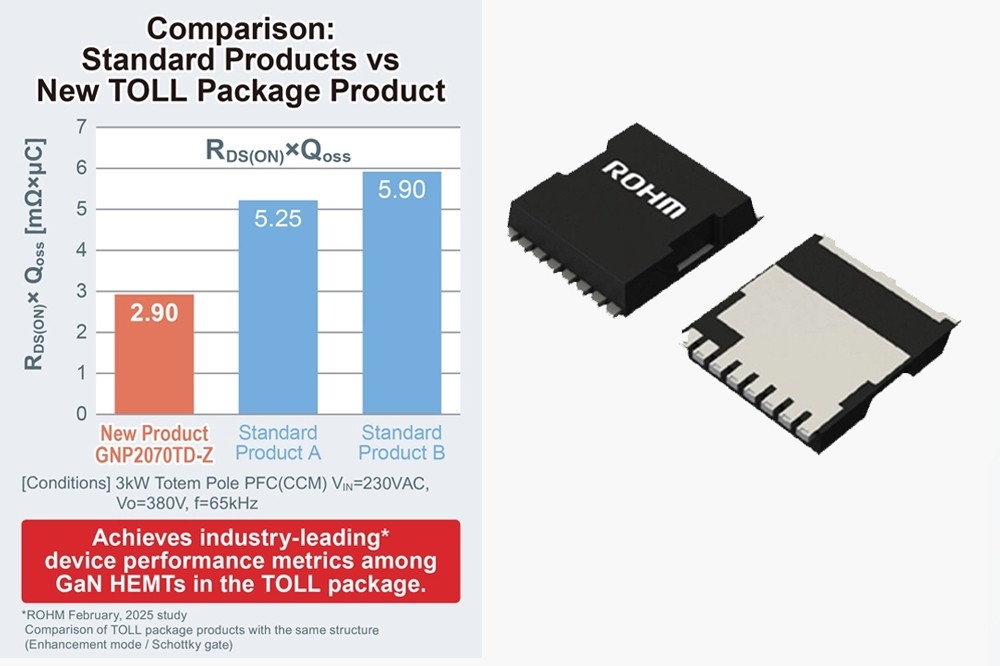

Following the SiC boom, OEMs are showing stronger interest in GaN for power electronics applications. This interest has led to a change in the landscape. The power GaN market is projected to grow beyond $2 billion by 2029, with a strong 5-year CAGR, according to Yole Group’s analysts.

As of 2025, Innoscience, Power Integrations, and Navitas lead the power GaN market. In parallel, semiconductor giants Infineon Technologies and Renesas grew by acquiring GaN Systems and Transphorm, respectively.

Poshun Chiu, senior technology and market analyst, compound semiconductors at Yole Group said: "It has also created synergies with GaN for RF applications. Companies like Infineon Technologies and GlobalFoundries, having invested in power GaN-on-Si, are exploring synergies to leverage existing equipment, such as epitaxy, for RF production."

RF applications : a unique perspective?

RF GaAs was the first compound semiconductor to achieve success in consumer applications, with a well-established ecosystem by 2025. Skyworks leads the market, followed by Qorvo and Murata, securing design wins in consumer end systems. However, geopolitical restrictions are driving Chinese OEMs to develop a local ecosystem.

Aymen Ghorbel, technology and market analyst, compound semiconductors at Yole Group said: "RF GaN was initially adopted in defence applications like radar, but over the past decade, it has expanded into telecom infrastructure, meeting 5G base station requirements. Interest in satellite communications and other use cases has also grown."

The AI boom: driving datacom growth and powering compound semiconductors

Semiconductor lasers drive the photonics compound semiconductor industry with an expected $5 billion market by 2029. These technologies are widely used in communication, sensing, and more. With the rise of AI, the datacom sector has experienced significant growth, driving strong demand for silicon photonics.

At Yole Group, analysts have identified a growing number of collaborations between the InP photonics and silicon industries. Major semiconductor giants like TSMC are entering the photonics business. And step by step, more players, such as GlobalFoundries and Samsung, may follow in the future.

MicroLED display, a fragmented landscape

The microLED display industry is highly fragmented, with no single entity overseeing manufacturing from start to finish. Unlike traditional vertically integrated display production, microLED manufacturing requires distinct expertise.

Major display makers like BOE and AUO are securing control over LED suppliers, while startups and equipment makers contribute to major technologies. Geographic alliances, particularly in China and Taiwan, are shaping industry dynamics.

Apple’s withdrawal has slowed funding, leaving most startups struggling and undermining confidence in microLED’s prospects.