Technical Insight

A positive outlook for the SiC substrate

Sales of SiC substrates will rise significantly as shipments shift to the 6-inch format and established suppliers face increased competition from Chinese start-ups. Pierric Gueguen, an analyst from Yole Développement covering the power electronics and compound semiconductor markets, discusses all this and more in an interview with Richard Stevenson.

Q: Over the years, there have many firms that have developed manufacturing processes for SiC substrate production. They include big names, such as Cree; starts-up that have been acquired, such as SiCrystal that is now owned by Rohm; and firms such as Caracal, which has vanished without a trace. Where does the SiC substrate industry stand today?

A: In general terms, you are yet to have a strong application that drives the market. In the past we expected this market to grow at a higher growth rate [than it did], but that didn't happen. What happened is that in some cases we had some consolidation. That is the case with SiCrystal. We have some major companies today that take all the market. And these companies are supplying integrators and device makers. Some device makers want several sources, which is why if you are one of the two or three main companies, you get almost all the market.

Q: Do some of the SiC substrate makers distinguish themselves from their rivals by employing a different, and arguably superior, growth technology?

A: There is not that much difference in the main process today "“ it's sublimation. If you look at the options for crystal growth of SiC, you will see several solutions, but the mainstream is sublimation.

When you target the semi-insulating SiC substrate for RF applications, you will see some more technical aspects. Today, we have seen patents that block and lock the market for only three main players that manufacture semi-insulating substrates.

Q: When it comes to price, is there much different between vendors?

A: Yes, definitely. What we try to do is establish an average selling price. But today the pricing depends on two things: The volume and the business model.

In a similar situation to what happens at the device level, you have only a few big companies that have almost all the market, and they are pulling huge volumes compared to the overall market. These ones are able to negotiate, and they have access to lower costs for SiC wafers compared to other companies.

And then you have really different business models, depending on whether or not the company is doing the epitaxy, and whether or not it is making its own SiC wafers. This has a huge impact on the wafer price.

Q: Are the vast majority of substrates now the 4H polytype?

A: Yes, definitely. SiC substrates started with the 6H polytype, but the 4H polytype is now mainstream and it will stay that way for many years.

Q: Do customers still have concerns related to the quality of SiC substrates?

A: Yes, mostly in power applications. Today we discuss [the issue of quality] a lot with integrators and OEMs that are willing to implement SiC wafers, and devices that are made on top of them. What happens is that they fear long-term reliability, and due to crystal quality issues, they are not able to manufacture large-current capability devices. The power devices that you have with SiC today do not have that high a current rating.

Q: Are the concerns over material quality related to defects, such as carrots and basal plane dislocations?

A: Yes. Today the main focus is on this. There are fewer and fewer micropipes. When you are manufacturing the SiC MOSFET, you have other reliability issues, like the gate oxide.

Q: What is the most popular size of substrate today, and how might this change going forward?

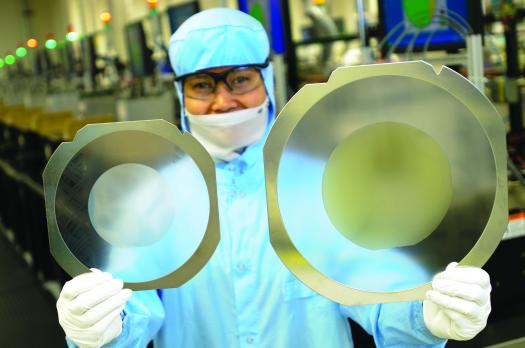

A: The most popular today is the 4-inch wafer. We are moving slowly towards the 6-inch wafer, and this move will last two or three years. At Yole, we have seen the first prototypes of the 8-inch wafer for SiC by II-VI, earlier this year. But to us, that will remain a prototype.

Q: Today, how do 4-inch and 6-inch substrates compare in quality and cost?

A: In terms of cost, we have a ratio today of about 2.25. The ratio we estimate for 2020 will be around 2. When you have to pay twice the price for a 6-inch wafer, even if you have a larger area, we don't think that will really be a breakthrough technology for price reduction in the SiC market. We see this trend that 6-inch will come, mainly because [it is favoured] in terms of productivity. But we are not convinced that in terms of direct costs, it will have an important impact.

In spring 2013 Cree released its second generation of SiC MOSFET, manufactured using its SiC substrates. These devices, now made and sold by Wolfspeed, deliver half the cost-per-amp of their predecessors.

Q: In terms of quality, is 6-inch inferior?

A: Today it's quite inferior. Devices that are manufactured on 6-inch wafers are diodes, because it is easier to make diodes than MOSFETs on top of wafers with a lower crystal quality.

Q: Cree consumes many SiC substrates for its own LED production. What is your estimate of the value of this captive market, and how does it compare to the merchant market?

A: Cree has a vertically integrated LED business. We have some estimation from their LED revenue, compared to other business units. I cannot disclose that, but I can say that more than 70 percent of their markets are for LEDs. Then after, they are using their SiC wafers for power and RF, plus the merchant market, because they are also selling their SiC wafers.

What is interesting is that even though Cree sells fewer wafers than it uses for its LED production, in the merchant market Cree is an important player. Their market share, roughly, is one-third of the market.

Q: Outside of LED production, how do sales break down between substrates for power electronics and for RF electronics?

A: In the past, it was more power. But at the moment we see a strong interest in SiC in RF applications. I would say that today we are more 50-50.

Q: When it comes to power electronics, historically the vast majority of substrates have been used to make Schottky barrier diodes. Is that still the case, or are there now significant sales of substrates for making SiC MOSFETs?

A: 80 percent of the market for SiC devices is for diodes. This share of 80 percent will roughly remain in the coming years, because the diode is really easy to implement, there are not major reliability issues, and in some applications it has already been identified as providing strong added value.

Of all the forms of wide bandgap substrate, that made from SiC is by far the most mature. (Source: SiC, GaN and other WBG materials for power electronics applications report, Yole Développement, October 2015)

Q: Are sales of SiC substrates under threat from GaN-on-silicon devices?

A: I don't think so. What we have done this year is that for each application we have compared the added value of SiC and GaN-on-silicon. We ended up with a pretty clear picture of where SiC will find its market and where GaN-on-silicon will find its home.

We have identified only a very few applications where you will have strong competition between SiC and GaN. We have a huge share of the GaN market that is linked to a low voltage range, while SiC has the pole position in higher voltage ranges. The boundary is around 600 V.

Q: How fast will the SiC substrate market grow over the next few years?

A: We have estimated an annual growth rate of 21 percent year-to-year, from now to 2020.

Q: Is there much profit to be made in SiC substrate production? Or do firms need to be more vertically integrated in order to enjoy healthy margins?

A: This is a tricky question. What we think is that there is added value in having internal manufacture of SiC substrates, in order to have the right process in terms of quality, and being able to monitor this.

But we see Chinese SiC wafers coming on the market, and that could have an important impact on the pricing of wafers. At the moment, the status is that we have overcapacity of SiC wafers, so you have pressure on the price.

Q: Given your market outlook, do you expect consolidation, expansion, or little change in the number of SiC substrate suppliers over the remainder of this decade?

A: We think that you will have both. You will have small companies that will have to consolidate in order to compete with the existing big players. And the ones that are already big will continue to expand. They will be the first to benefit from market growth.

At the same time, you will have more and more Chinese companies that pop up in the market. We don't think that every single Chinese company will remain, so you will have consolidation in this area. But overall, you will have more SiC suppliers.

Also, you may have other semi-insulating SiC wafer manufacturers in the future. Today it is a closed market, because only a few suppliers can supply this type of SiC wafer.

According to Yole, the SiC wafer market will grow at a compound annual growth rate of more than 20 percent through the remainder of this decade. (Source: SiC, GaN and other WBG materials for power electronics applications report, Yole Développement, October 2015).