News Article

RF GaN Revenue to Reach Nearly $560 Million in 2019

According to a new market research report GaN RF Market Update: 2014 - 2019 from Strategy Analytics, the market for RF GaN devices will reach nearly $560 million by 2019, with a CAGR approaching 22 percent from 2014 to 2019.

After years of promise, but slow growth, the GaN RF market has finally taken off and it appears positioned for strong long-term growth. The defense industry has long been a supporter of GaN, providing the resources for GaN device, process and technology development for more than a decade. These applications continue to take advantage of the power and performance advantages that GaN offers, but the adoption is changing slightly.

Land-based EW systems, with their high-power, wide bandwidth requirements and airborne radar systems that benefit from size and weight reductions appeared to be the best initial fit for GaN technology. These two applications were the early adopters of GaN, but usage has responded to a changing geo-political landscape. Initial land-based EW systems focused heavily on counter IED networks in asymmetric battlefield situations. With the reduction of US forces in Iraq and Afghanistan, this activity has decreased markedly. In addition, the anticipated uptake of GaN in AESA radar systems has been slow to materialize. Overall budget and program funding uncertainty has delayed and/or reduced the spending on new platforms and this is reducing the rate of GaN adoption in these applications.

Despite a change in the anticipated usage scenarios, military applications continue to represent opportunities for GaN adoption. While growth rates for RF GaN devices in land-based EW and airborne radar systems have declined, they still represent the two largest sources of GaN revenue in military applications.

Tactical communications equipment will continue to benefit from the bandwidth and power capabilities of GaN and this segment will experience the fastest growth in device revenue. By 2019, this segment will account for the largest portion of the RF GaN defense revenue. The report speculates that AESA radar systems will move beyond fast jet applications and experience increasing deployment in land and sea-based radar applications. This segment will be the second largest user of GaN RF devices by 2019. Shifting battle philosophies will positon RF GaN device revenue in EW systems behind these other applications. "Applications for RF GaN devices are growing much more quickly than defense budgets," states Strategy Analytics analyst Asif Anwar. "We anticipate broad adoption of GaN RF devices in radar, communications and EW applications will fuel impressive revenue growth."

The biggest change in RF GaN usage comes from commercial applications. Previous research indicated that the commercial market for GaN-based RF devices was tantalizingly close to the tipping point for broad adoption. It now appears clear that the market has passed this point as evidenced by strong adoption in wireless and CATV/broadband infrastructure, along with the first reports of GaN usage in microwave/millimeter wave radios, VSAT and industrial applications.

While CATV/broadband infrastructure was the first commercial application to use GaN widely for power amplifiers, wireless infrastructure applications have exploded in the past year or so. Initially relegated to low volume applications in the Asia-Pacific region, GaN-based power amplifiers have shown the right mix of production maturity and competitive pricing, coupled with performance advantages to capture a growing share of the new LTE wireless infrastructure deployments. This segment of the commercial market has gotten a substantial boost from efforts in China to establish a nationwide LTE network. While GaN usage is still much smaller than LDMOS in these wireless infrastructure applications, the scope of the Chinese LTE deployment in 2014 was enough to make this the largest commercial segment.

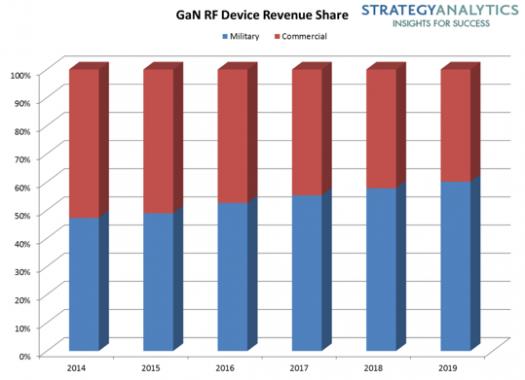

As the chart below shows, the magnitude of RF GaN revenue in wireless infrastructure applications, coupled with adoption in a variety of other applications was enough to push the commercial segment to slightly more than half of the total revenue. The report anticipates that faster growth in the defense sector will propel that segment to more than half of the RF GaN revenue by 2016 and roughly 60 percent in 2019.

Land-based EW systems, with their high-power, wide bandwidth requirements and airborne radar systems that benefit from size and weight reductions appeared to be the best initial fit for GaN technology. These two applications were the early adopters of GaN, but usage has responded to a changing geo-political landscape. Initial land-based EW systems focused heavily on counter IED networks in asymmetric battlefield situations. With the reduction of US forces in Iraq and Afghanistan, this activity has decreased markedly. In addition, the anticipated uptake of GaN in AESA radar systems has been slow to materialize. Overall budget and program funding uncertainty has delayed and/or reduced the spending on new platforms and this is reducing the rate of GaN adoption in these applications.

Despite a change in the anticipated usage scenarios, military applications continue to represent opportunities for GaN adoption. While growth rates for RF GaN devices in land-based EW and airborne radar systems have declined, they still represent the two largest sources of GaN revenue in military applications.

Tactical communications equipment will continue to benefit from the bandwidth and power capabilities of GaN and this segment will experience the fastest growth in device revenue. By 2019, this segment will account for the largest portion of the RF GaN defense revenue. The report speculates that AESA radar systems will move beyond fast jet applications and experience increasing deployment in land and sea-based radar applications. This segment will be the second largest user of GaN RF devices by 2019. Shifting battle philosophies will positon RF GaN device revenue in EW systems behind these other applications. "Applications for RF GaN devices are growing much more quickly than defense budgets," states Strategy Analytics analyst Asif Anwar. "We anticipate broad adoption of GaN RF devices in radar, communications and EW applications will fuel impressive revenue growth."

The biggest change in RF GaN usage comes from commercial applications. Previous research indicated that the commercial market for GaN-based RF devices was tantalizingly close to the tipping point for broad adoption. It now appears clear that the market has passed this point as evidenced by strong adoption in wireless and CATV/broadband infrastructure, along with the first reports of GaN usage in microwave/millimeter wave radios, VSAT and industrial applications.

While CATV/broadband infrastructure was the first commercial application to use GaN widely for power amplifiers, wireless infrastructure applications have exploded in the past year or so. Initially relegated to low volume applications in the Asia-Pacific region, GaN-based power amplifiers have shown the right mix of production maturity and competitive pricing, coupled with performance advantages to capture a growing share of the new LTE wireless infrastructure deployments. This segment of the commercial market has gotten a substantial boost from efforts in China to establish a nationwide LTE network. While GaN usage is still much smaller than LDMOS in these wireless infrastructure applications, the scope of the Chinese LTE deployment in 2014 was enough to make this the largest commercial segment.

As the chart below shows, the magnitude of RF GaN revenue in wireless infrastructure applications, coupled with adoption in a variety of other applications was enough to push the commercial segment to slightly more than half of the total revenue. The report anticipates that faster growth in the defense sector will propel that segment to more than half of the RF GaN revenue by 2016 and roughly 60 percent in 2019.