The inverter industry is about to change

In its new report "Inverter Technology Trends & Market Expectations". The inverter market will be driven by three factors: electrification trends in transportation, the need for power conversion optimization for CO2 emission reduction, and the development of clean electricity sources. Such strong and sustainable drivers will make the inverter market grow. In parallel, Yole's analysts clearly identify a transformation of the inverter market supply chain: the inverter industry is about to redefine itself "¦

"Inverter Technology Trends & Market Expectations" report analyses seven inverter market segments: Photovoltaics, wind turbines, EV/HEV, electric & hybrid buses, rail traction, UPS, and motor drives and related market forecasts for the period 2013-2020. "The largest markets in 2020 (in revenues) will be represented by motor drives, UPS, and PV", explains Dr Pierric Gueguen, Activity Leader, Power Electronics and Compound Semi., at Yole. "The strongest market growth will be featured by EV/HEV, with 18.3% CAGR (in revenues) between 2013 and wind and UPS markets remaining almost flat", he adds.

The inverter market is heavily application dependent. However, there are some cross-fertilization trends "” companies with a good position within one inverter market segment are researching entry into other segments. Companies like Alstom, ABB, Ingeteam, Siemens, and General Electric already offer products in two or more inverter segments. "Some players have chosen vertical integration to optimize their internal cost structure to better target commodity-like markets, as well as to meet the severe cost requirements of the automotive industry", comments Dr Milan Rosina, Technology & Market Analyst, Energy Conversion & Emerging Materials, Yole. "Other players have bet on horizontal integration to offer complete solutions to customers", he says.

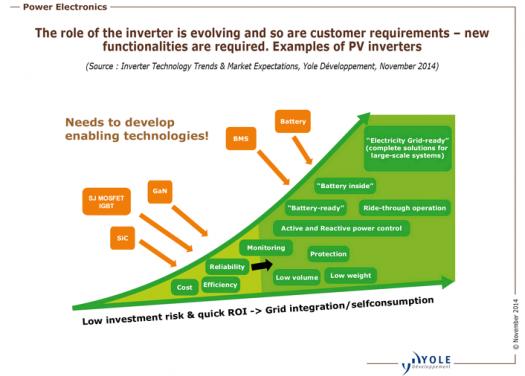

The inverter supply chain is changing to align with new customers' requirements. This was first learned in the PV industry when the first SiC inverters were introduced several years ago by SMA and REFUsol (now AEI), since then the highest customer priority has changed from high efficiency to low cost.

The reshaping of the inverter supply chain is the most pronounced when analyzing the local market drivers and players. In this report, Yole's analysts focus on China and Chinese players that heavily impact the overall market in most inverter applications.

Understanding the characteristics of a local market is important in identifying the most promising market sectors and also helps in choosing the right product mix and the optimal sales strategy. Companies which can anticipate regional market changes are on the best path to conquering new markets, and will lose less in weakened markets. China and Japan remain the markets with relatively difficult access for foreign players, and thus are dominated by local companies "” except for the rail and UPS application markets. Many European and US companies are working to improve their position within the huge growth potential markets "” PV, wind, and electric vehicles.