Transphorm Q4 and yearly revenue down

Company expected to resume product revenue growth in Q2 2024, says CEO

GaN specialist Transphorm has announced financial results for the fiscal fourth quarter and year ended March 31, 2023.

Q4 revenue was $3.2 million compared to $4.5 million in the prior quarter and $4.9 million for Q4 2022. The company says this was primarily impacted by a government contract delay, the revenue from which will be recognised commencing in the first quarter of fiscal 2024. Product revenue for Q4 2023 was at the company’s targeted $3.2 million.

Revenue for the full fiscal year of 2023 was down to $16.5 million, compared to $24.1 million for 2022, due primarily to an $8.0 million decrease in licensing revenue. 2023 product sales were $14.7 million, an increase of 21 percent compared to fiscal 2022.

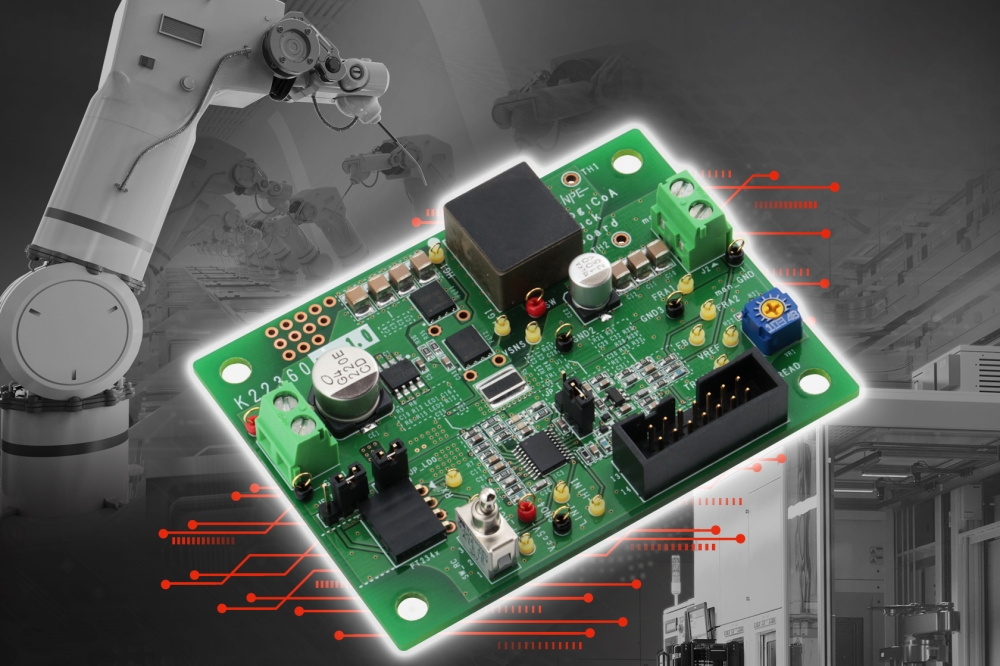

Increased design-ins and opportunities nearing or in production are currently expected to result in sequential product revenue growth resuming in the second quarter of fiscal 2024, according to the company.

“We continue to see strong fundamental growth trends driven primarily by increased design wins for both the high-power and low-power market segments. We believe these trends point to the company resuming sequential product revenue growth beginning in the second quarter of fiscal 2024,” commented Transphorm’s president, CEO and co-founder, Primit Parikh.

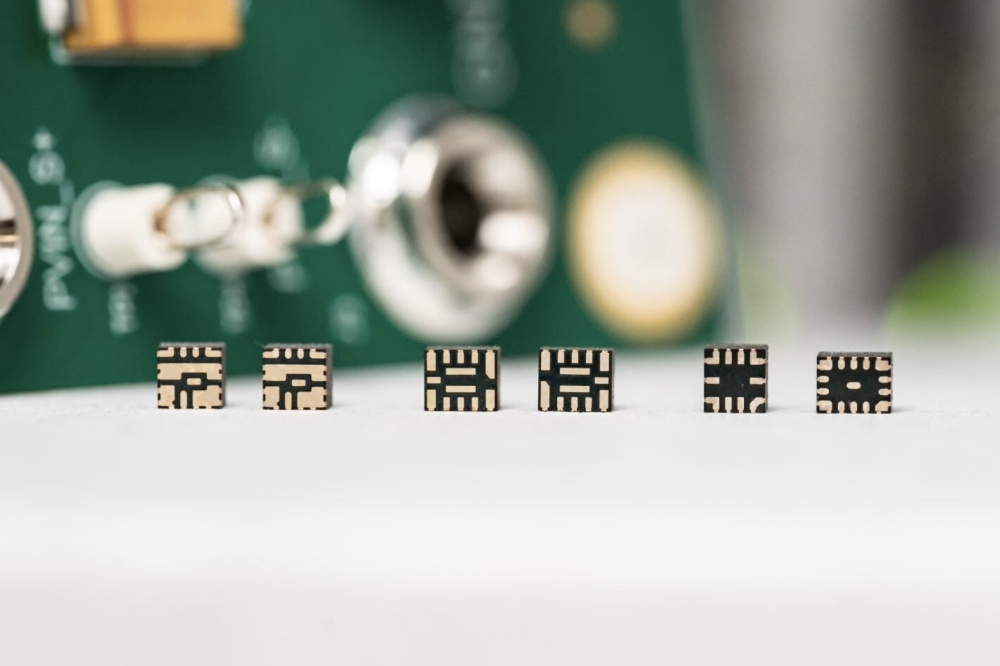

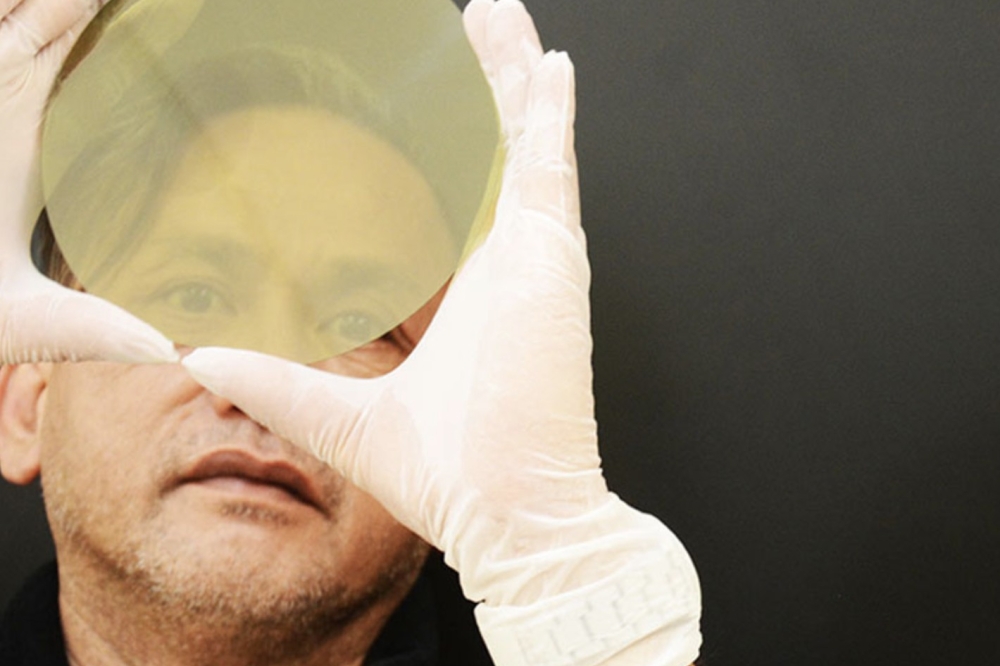

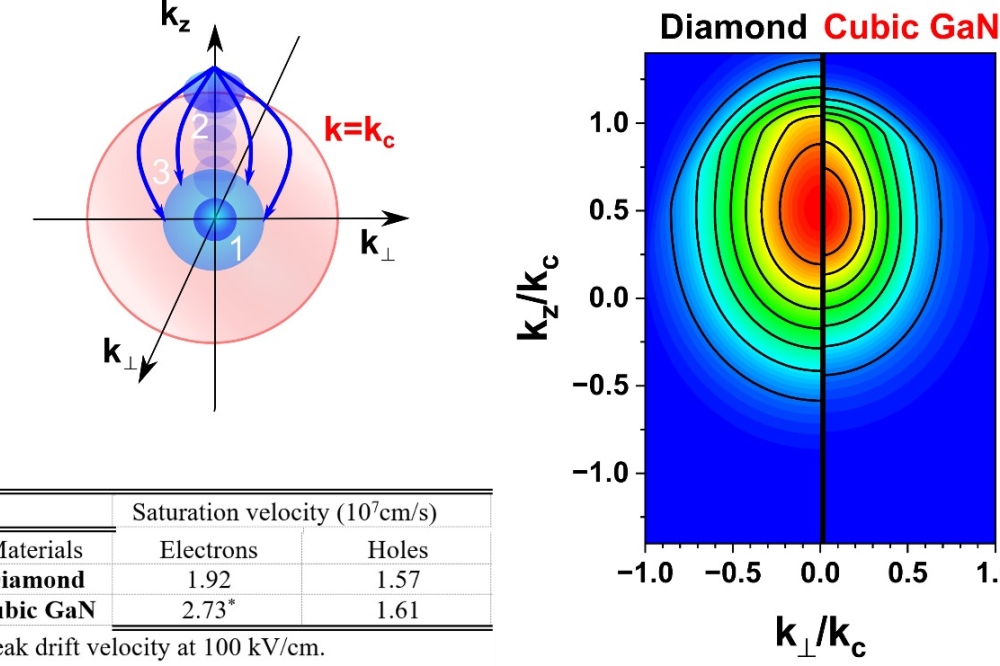

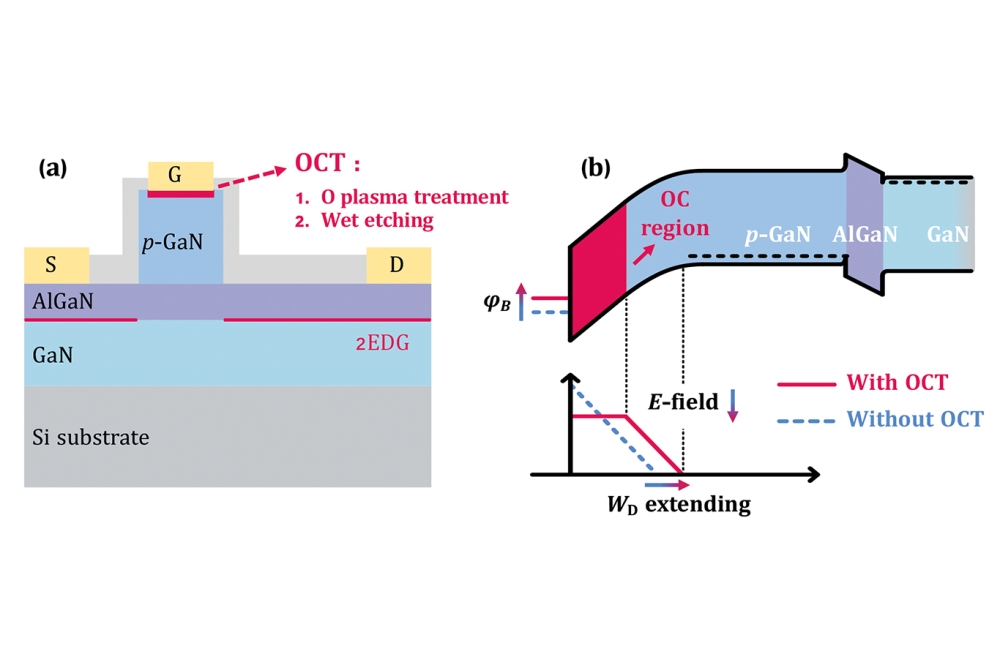

“Our differentiated GaN semiconductors lead the industry in performance and reliability, carrying the only reported broad power spectrum reliability ratings for GaN power and over 175 billion hours in the field. Our increased design-ins, the end customer momentum in ramping GaN, and the recent broad market excitement in GaN power is driving our desire to commence a strategic review of various opportunities to enhance shareholder value.”

“We believe the past quarter and fiscal year have been extremely important toward positioning us strategically for future growth. We expect our recently announced rights offering and the asset-based debt financing initiatives we are pursuing will significantly improve our cash position and put us in a strong position to pursue the increased opportunity funnel and allow us to focus on product innovation, operational capabilities and collaborative opportunities,” stated Cameron McAulay, CFO.

2024 Q1 guidance

For the first quarter of fiscal 2024, the company expects: revenue in the range of $5.8 million to $6.2 million; GAAP gross margins in the 30-34 percent range; and GAAP net loss per share in the $(0.10) to $(0.13) range.