Getting strategic with SiC

As we gradually transition from fossil fuels, the world is waking up to the critical importance of power semiconductors

Efficiency, electrification and CO2-reduction are watchwords for our age, but they are only part of the story behind the recent flurry of SiC chip fab investments. From Wolfspeed’s plans to build the world’s largest SiC plant in Germany, to Mitsubishi’s intended construction of an 8-inch SiC wafer plant in Japan, these projects are as much about simmering global tensions and safeguarding chip supplies as they are about climate change.

We see this most strikingly in the US government’s $52.7B package of subsides for domestic chipmaking as part of its Chips Act, closely followed by the EU’s $47B plan. The EU aims to be totally self-sufficient in semiconductors; this is onshoring on a big scale. Moreover, it wants to build market share from 10 to 20 percent by 2030.

Japan is dedicating $2.8B to chip subsidies, which includes covering up to one third of capital investments in power semiconductors.

The UK released its long-awaited National Semiconductor Strategy in May, focusing on semiconductor design, compound semiconductors, and R&D. The UK government will invest a modest £200 million over the next two years, and up to £1 billion in the next decade to support growth of the home-grow compound semiconductor sector. So far, no fab funding.

How will this pan-out? According to Yole Group’s estimates last year, SiC power devices will represent 30 percent of the overall power device in the next four years, with a market potential of over $6 billion by 2027, up from around $1 billion in 2021.

Will the market be there, and is there a risk of undersupply or oversupply?

Interestingly, as part of the European Chips Act the European Commission has launched a Semiconductor Alert System, a new pilot to monitor the semiconductor supply chain, allowing stakeholders to raise awareness on any critical disruption along the semiconductor value chain. The idea is that the Commission can quickly react to any potential crisis situation.

The semiconductor industry is well known for its cycles of fab building followed by oversupply. Boom usually follows bust. But SiC chip makers are bullish. Onsemi and ST Microelectronics have both announced aims to secure $1bn in SiC business in 2023. Infineon wants 30 percent share of the global SiC market by the end of the decade.

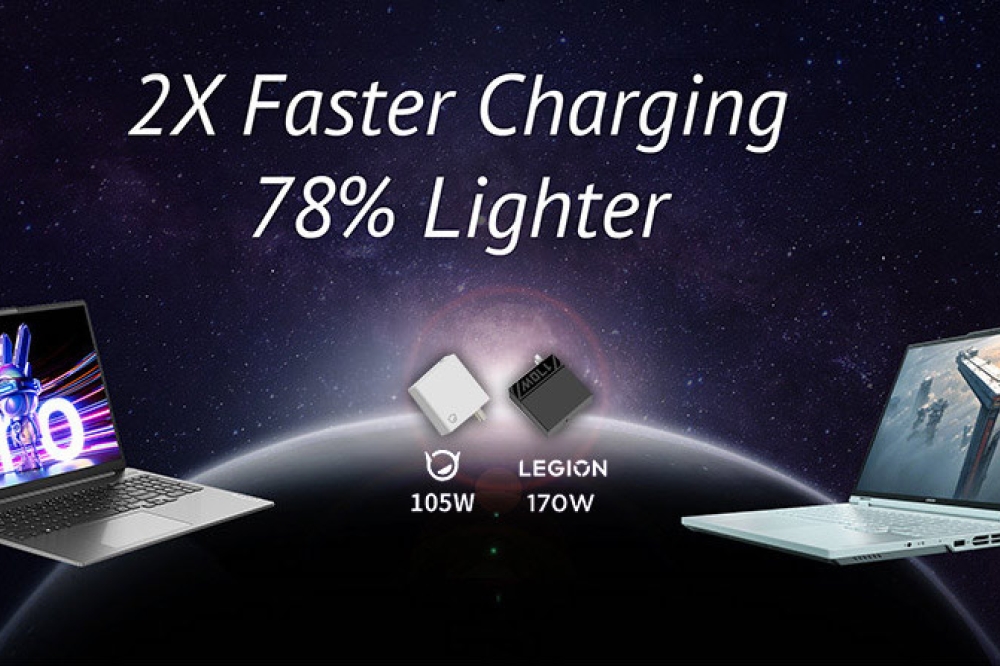

Cars are the main focus of the SiC gold rush. Data from Infineon shows that vehicle semiconductor content is expected to rise from ~$490 per vehicle for an internal combustion engine vehicle to ~$950 for a battery electric vehicle (BEV). Power semiconductors will drive much of this content increase, especially from the high-powered inverters used to drive the electric motor.

Exawatt, a UK market analysis firm, forecasts that by 2030 over 95 percent of passenger BEVs will use SiC MOSFETs in their powertrains. It also expects BEVs will account for more than 50 percent of annual passenger vehicle sales by 2030. Exawatt also predicts that SIC-based inverters will surpass silicon-based inverters by 2024. By 2030 95 percent of battery electric vehicles will use SiC based semiconductors in their powertrains.

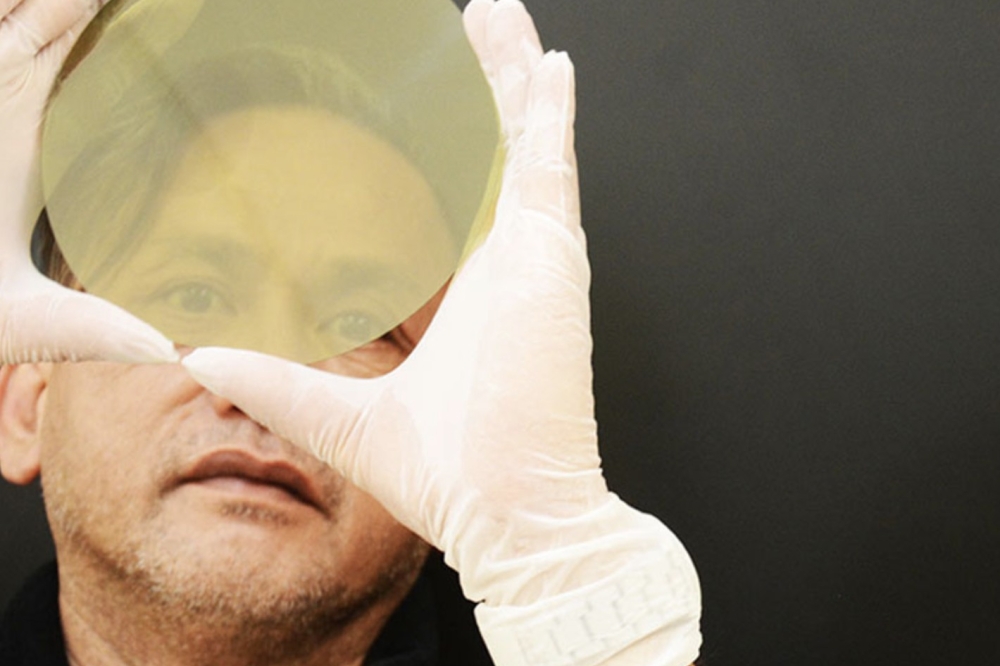

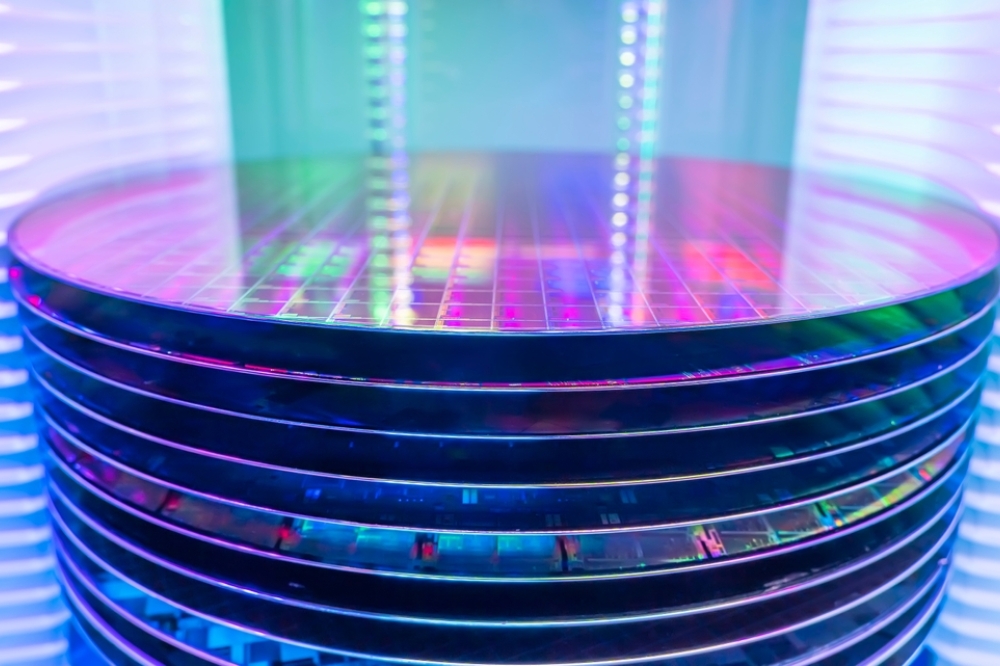

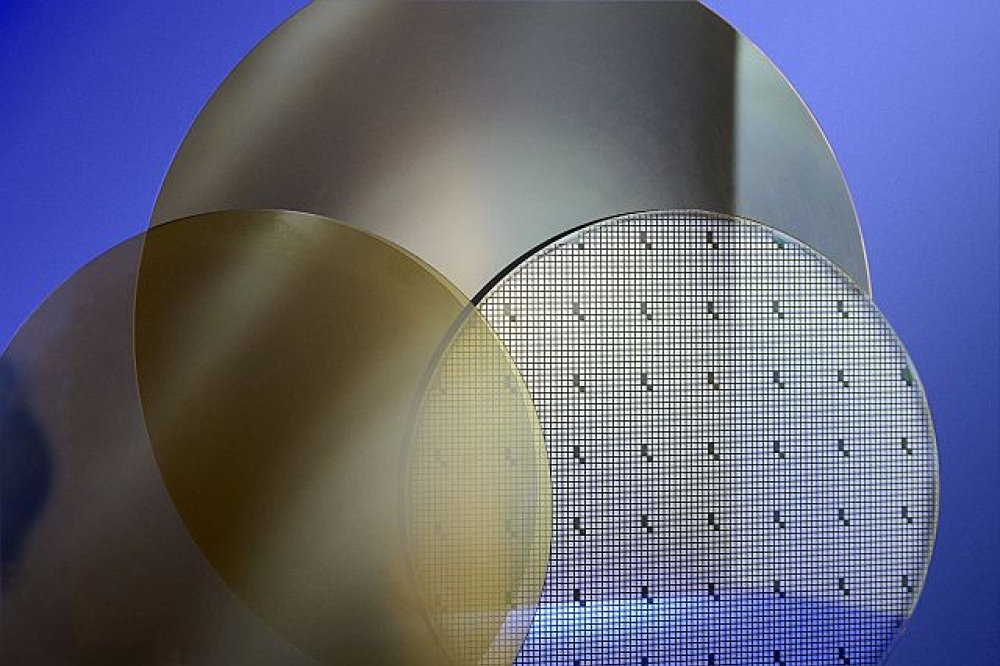

According to Angelique van der Burg, chief procurement officer at Infineon, her company is doubling down on its SiC investments. “In this context, we are implementing a multi-supplier and multi-country sourcing strategy to increase resilience to the benefit of our broad customer base,” she said, about recently signed deals with two Chinese SiC suppliers ¬– TanKeBlue and SICC – under which they will supply Infineon with 150 mm SiC wafers and boules and support Infineon’s transition to 200mm wafers. Infineon already has an agreement with the US firm Coherent (formerly II-VI) to supply 150mm substrates, and to collaborate on 200 mm, signed last year.

STMicro is building a pilot line for wafers and a processing frontend in Catania, Sicily, alongside its existing SiC fab. It aims to increase the front-end capacity ten-fold and will have 40 percent of substrates internally sourced by Q4 2024, starting with 150 mm and moving to 200 mm.

US firm Onsemi aims to expands it SiC boule production capacity by five times year-over-year as part of its plan to gain full control of its entire SiC manufacturing supply chain, starting with the sourcing of SiC powder and graphite raw material to the delivery of fully packaged SiC devices. In-house sourcing of wafers is key to its strategy.

To boost SiC research in the US, Onsemi has also just signed an MOU with Penn State University to build an $8 million collaboration with the establishment of a SiC Crystal Center at Penn State’s Materials Research Institute (MRI). Onsemi will fund the centre with $800k per year over the next ten years.

“Penn State is uniquely positioned to rapidly establish a SiC crystal growth research program,” said Pavel Freundlich, chief technology officer, Power Solutions Group, Onsemi. “The university offers a wide breadth of capability based on its current materials research, wafer processing capabilities in its nanofab facility, and a comprehensive, world-class suite of metrology instrumentation.”

Cars, cars, cars

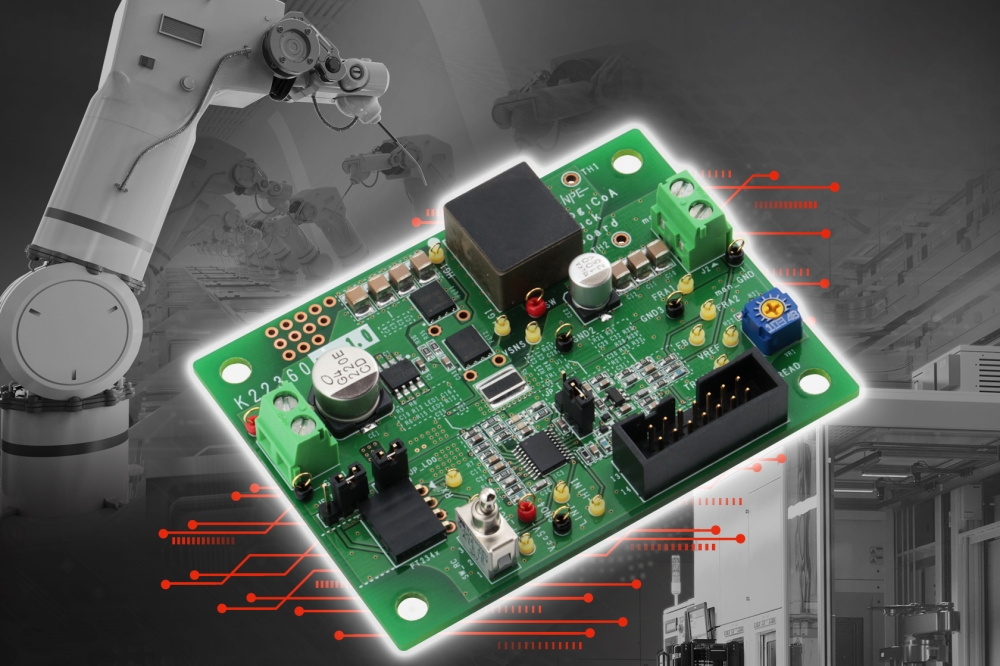

Alliances with automotive companies are central to the SiC story. ST has recently announced that it has 25 ongoing electric vehicle projects with eight customers. Infineon, which provides SiC semiconductors to more than 3,600 automotive and industrial customers, has just signed an agreement with Hon Hai Technology Group (Foxconn), the Taiwanese electronics manufacturing services provider, to work together on electric vehicles and establish a system application centre in Taiwan.

Wolfspeed has a strategic partnership with the huge German automotive systems company ZF Friedrichshafen AG, which supplies systems for passenger cars, commercial vehicles and industrial technology. ZF and Wolfspeed also plan to establish a joint European R&D centre for SiC power electronics in Germany in the Nuremberg area.

Onsemi will be supplying Volkswagen with SiC modules and semiconductors for an EV traction inverter solution. The company also has a long-term supply agreement with BMW, signed in March 2023, for electric drivetrains. Added to these are a collaboration with the Finnish firm EV charging company Kempower around SiC MOSFETs and diodes, and a tie-up with the Chinese electric mobility firm Zeekr, a developer of battery technologies, battery management systems, and electric motor technologies.

Rohm, meanwhile, has a joint development agreement with Mazda Motor Corporation and Imasen Electric Industrial for inverters and SiC power modules to be used in the electric drive units of electric vehicles.

These are just a handful of announced SiC alliances. But “strategic’” is more than just a throw-away term. It means long-term reliable supplies for the car companies, and guaranteed customers for the output of the soon-to-be burgeoning SiC fabs.