The silicon carbide substrate supremo

As SiC substrates sales soar, Cree’s Wolfspeed division is ramping

capacity to maintain a vice-like grip on this market. Offering insight

into how to scale, the art of crystal growth and massive expansion plans

CEO GREG LOWE TALKS TO RICHARD STEVENSON

RS: Elon Musk, vying with Jeff Bezos for the moniker of the richest man in the world, has made his fortune through the soaring share price of Tesla, the pioneer of electric vehicles that employ SiC power devices. With the future for Tesla now looking brighter than ever, can we expect sales of SiC substrates to outpace recent predictions?

GL: The adoption of EVs and the drive for more efficiency, whether its electric vehicles or industrial systems, is definitely driving an increased adoption rate for silicon carbide. We’re in the early stage of a transition in semiconductors that happens only once every fifty years. That’s a transition from a silicon substrate to a silicon carbide substrate. The last time the semiconductor industry saw such a dramatic change was when digital designers went from bipolar transistors to CMOS.

RS: Aside from power electronics for electric vehicles, what do you see as the big markets where SiC substrates have a role to play?

GL: We recently announced two sets of products: back in April last year a 650 volt MOSFET product; and more recently, a month or so ago, a 1200 volt product. We are seeing tremendous interest in industrial markets for those types of products, things like solid-state circuit breakers, grid-connected devices, medical instruments. We are seeing adoption and interest in, just as an example, industrial blenders – think of them as mixers for chemical and industrial-type products, where power efficiency is really key. It’s a similar situation in server farms. Power is a tremendous on-going cost, and reducing that cost by using more efficient systems is key.

With the 650 volt MOSFET product that we launched, we had over 7,000 different applications from companies that said “I would be in interested in using this.” Altogether, that was a billion dollars of opportunity. This is standard in the analogue industry, where you see lots of different applications. We are very excited about those markets.

RS: Historically, Cree manufactured its LEDs on silicon carbide, but it has been moving over to sapphire. Does the sale of the LED products business unit, Cree LED, to Smart Global Holdings, signify the end of LED manufacture on silicon carbide substrates?

GL: The transition from a silicon carbide substrate to a sapphire substrate started a couple of years ago. The acquisition of our LED business by Smart Global will certainly continue that transition. Eventually, [Smart Global] will take the LED business and make it largely a sapphire business.

What we are doing is taking the capacity we allocated for LEDs and silicon carbide and converting our capacity to a Wolfspeed business. You will see the transition of LEDs from silicon carbide to sapphire, and with the selling of the business, it will move to an outsourced model as well. We will focus all of our silicon carbide business on the Wolfspeed business – power, and the RF business.

RS: Cree has been involved in high-profile wafer supply agreements, such as those signed with STMicroelectronics and Infineon. Do you see more agreements being signed, or have supply constraints eased?

GL: The demand for silicon carbide continues to outpace supply. We’re on a billion-dollar expansion capacity, both at the wafer fab level and the silicon carbide substrate manufacturing level. Our goal is to increase our manufacturing output by 30 times from the baseline of 2017.

We’ve recently announced the second expansion and extension of our supply agreements. The first expansion and extension was with ST; we’ve announced the second expansion and extension, another $250 million deal.

I think the fact we have a fairly substantial percentage share [of the SiC substrate market], and that we are investing a tremendous amount of capex in expanding our manufacturing footprint, continues to drive customers our way, in terms of them looking for assurance of supply of silicon carbide substrates.

RS: What proportion of Cree’s substrates are used internally?

GL: We don’t split that out exactly, but between our device business and our silicon carbide business, roughly half is devices and roughly half is silicon carbide substrates. Over the coming years we would anticipate that our device business and our silicon carbide substrate business will grow, but the device business will likely grow faster than the substrate business.

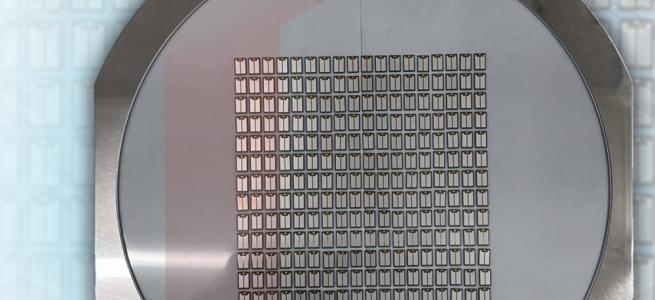

RS: Cree is in the midst of an expansion, with a ramp in silicon carbide production in Durham, and construction of a wafer fab in Mohawk Valley. Is the plan to use both sites for the production of silicon carbide substrates?

GL: Currently we’re planning an expansion of our silicon carbide manufacturing capability in Durham, North Carolina. We have a second site basically across the street from our first site.

The team working on the New York wafer fab has made tremendous progress, despite starting when Covid was just starting to devastate the U.S. We began the expansion and despite [the pandemic] the team has done a great job of staying on track. It will be the world’s largest silicon carbide wafer fab and the world’s first 200 millimetre-capable silicon carbide wafer fab.

RS: To increase silicon carbide substrate production there needs to be investment in more growth equipment and the introduction of more technicians to run these tools. Crystal growth is viewed by some as a black art, with experience critical. Is that your view, or is it a process that new technicians can master in a few months?

GL: It definitely takes a lot of experience. If you look at our experience in silicon carbide crystal growth, it spans three decades. Some of the folks that are working on the 200 millimetre project worked on quarter-inch silicon carbide crystals.

As we move from 150 to 200, you are talking about a new process to grow the crystals, new machines to grow the crystals – we actually build those machines ourselves – and the methodology to extract crystals with very low defect densities. That’s not easy to do. It remains an area that has tremendous barriers to entry.

Silicon carbide grows at a very, very high temperature, on the order of 2500 Celsius. You don’t start the process and then open it up halfway through to see how it’s going. You have to know what you’re doing before you get the machines ramped up to those kinds of temperatures. Even process monitoring, temperature monitoring, the way you do cooling, all of that is super-important to the quality of the crystal. And a lot of that is stored in the brains and the knowledge of our team. You can’t go down the street and buy a silicon carbide growth machine.

RS: My impression is that SiC substrate quality has increased, and there is less concern related to the various types of defect that can plague this material. When scaling to 200 millimetre silicon carbide, does much effort have to be devoted to ensuring that these imperfections continue to be minimal?

GL: Absolutely. There is a tremendous amount of effort on that. When we got out the first 200 millimetre wafers, we realized we had a lot of work to do on dislocations and defects. But the team has done a tremendous amount of work on that. You also have stresses that are induced. Typically, in the case of silicon carbide, crystal growth is hard because of the temperature you are working with. But the stresses increase as you increase the diameter, which impacts wafer shape – and that’s a big deal for the ability to use a wafer in a wafer fab.

Even at 150 millimetre, there has been an increase in quality. We’ve certainly be leading the charge on that – there is a need for increased quality at 150 millimetre. The adoption of silicon carbide in high-power markets, including automotive, industrial, grid applications, etc., is driving the increase in die size of silicon carbide chips. The increased size of the chips makes it more important that the defect density is lower, because the probability you have a defect in a bigger chip is higher. So there is improving quality that is tracking very closely the requirement for the improvement, and the demand for the improvement, but based on the size and the amount of power that customers are looking to get out of these chips.

RS: How does Cree ensure consistent, high-quality product? What do you do to monitor the quality of your substrates?

GL: We use a lot of product internally in our wafer fabs and that gives us immediate, very short-cycle-time feedback to our crystal growth team, in terms of improving quality and capability of the device, the substrate, of the epistructure, etc.

We also work very closely with our partners, like ST. They give us feedback as well. Customer feedback is the greatest way to know if you are making improvements. We feel pretty good about the feedback we are getting, in terms of the improvements we have made on the silicon carbide substrates, and then the epi capability as well.

RS: Where is Cree now, in terms of the ratio of its

100 millimetre and 150 millimetre production of SiC?

GL: We have made a pretty significant transition from 100 to 150. It’s in excess of 75 percent of our production. I would anticipate that the 100 millimetre will fade as a percentage of the business as we increase our capability at 150, and transition some of that capability to 200 millimetre.

RS: It seems that for silicon chip production, there is a sweet spot associated with the 300 millimetre wafer. 450 millimetre production is possible, but the benefits don’t seem to warrant the outlay. With GaAs, production has now been at 150 millimetre for more than a decade. With SiC, will 200 millimetre be the optimum?

GL: What I will tell you is that we feel very good about the transition we are making from 100 to 150, and then the introduction of 200 with the Mohawk Valley fab.

I think we’re in a transition to 200 millimetre for the next decade. If there is another wafer diameter beyond that, we’re probably talking about at the earliest, the end of this decade. That does track what normally happens in semiconductors. It’s a relatively high capital-intensive business. Companies build a 200 millimetre fab and then want to run it for at least a decade before they start converting it, so it matches the normal transition of wafer fabs.

RS: What gives Cree an edge over its rivals in the SiC substrate market. Is it the volume of supply, the quality of the product, or the pricing?

GL: I think it starts with a tremendous amount of experience – we have thirty years of experience with this technology. That experience translates into high quality; the high quality gets us access to customers and markets, which drives our scale up; the increase in scale allows us to have more learning cycles; more learning cycles helps us improve our yield and drive our costs down; and as we drive our costs down we’re are able to sign up more customers, which increases our scale, gives us more learning cycles.... you get the point, we’ve created a bit of a flywheel.

The long-term supply agreement customers – which includes, from an announcement perspective, ST, Infineon and ON Semiconductor – allow us to continue to drive costs down.

It has been a really important factor to utilize scale to drive improvements in productivity, yield, quality etc., to drive cost down. We need to get the price differential between silicon to silicon carbide lower and lower and lower. I think we’ve been able to achieve that over the last couple of years.

RS: You’ve recently announced that you’ve changed the name to Wolfspeed Cree. What’s the thinking behind that move?

GL: The company has a tremendous amount of legacy and capability and brand awareness as an LED and lighting company. That’s largely around the brand Cree. Now that we’ve sold the LED business, we really are a compound semiconductor company focused on power and RF chips, and silicon carbide substrates with gallium nitride capability as well.

The Wolfspeed brand has been out there for the last five years. It’s well known and well respected as that part of Cree that is the power and RF semiconductor part. So we felt this was the perfect time, as we close the sale of the LED business to Smart Global, to transition the name of the company to replicate what we’ve really become. The fact that we had the brand out there has given us the opportunity to do this.

We’re not creating a new brand, we are just simply saying that we are focusing on these businesses, no longer LED or lighting. It’s a great opportunity for us to highlight the focus of the company in these areas.