Power packaging: innovation and growth

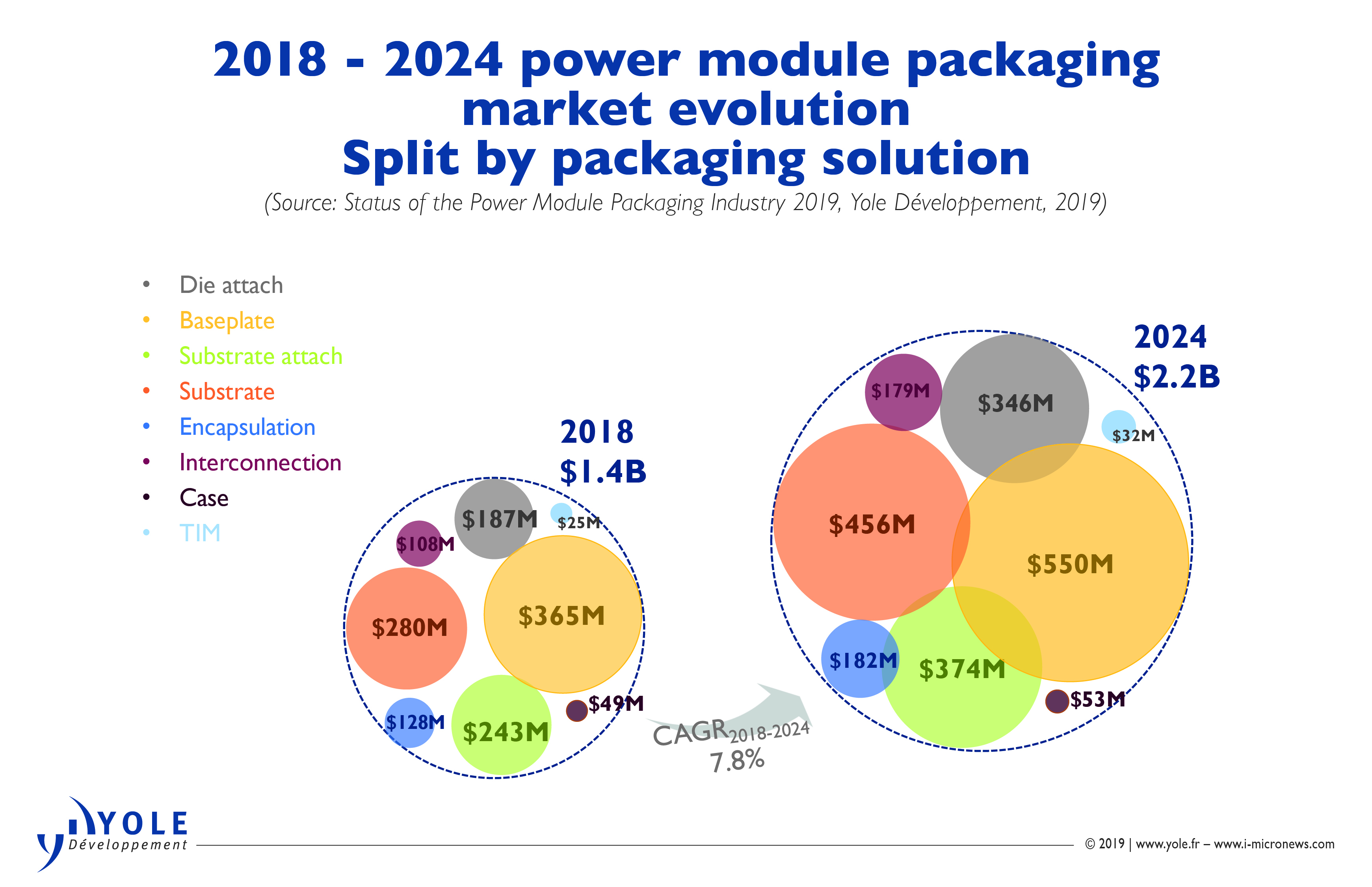

Packaging market for power modules will be worth $2.2 billion by 2024

Market research & strategy consulting Yole Développement has put together an optimistic analysis of the power electronics industry which shows how power packaging innovation is reshaping the supply chain.

The power device market is expected to see a comfortable 13.9 percent growth between 2018 and 2019, compared to 2017. This is the second consecutive high-growth year in this industry, after a couple of flat years. As a key element in power converters and inverters, the module market should reach about $6 billion by 2024 with 6.6 percent CAGR between 2018 and 2024.

In its latest report, 'Status of the Power Module Packaging Industry', Yole says that in addition, the packaging market for power modules will be worth $2.2 billion by 20214. The EV/HEV sector is an important driver as is the use of SiC and GaN technologies.

“Power module packaging is clearly a very dynamic market with constantly reshaping supply chain”, comments Milan Rosina, principal analyst, Power Electronics and Batteries, at Yole. “Continuous innovations, materials’ enhancements, lot of R&D investments are part of the today’s power module landscape.”

“In the past, packaging needs were driven by industrial applications, but today the market has changed and future will be different”, announces Shalu Agarwal, power electronics and materials analyst at Yole.“Indeed, EV/HEV will be the main player. At Yole, we think, EV/HEV will become the biggest power module market by 2024 and will represent a $2.5 billion market in value”.

This market’s promising outlook proposed by the power electronics team at Yole, is clearly beneficial for the power module packaging material business. Therefore, the power module packaging material market will achieve a 7.8 percent CAGR between 2018 and 2024, reaching the $2.2 billion business opportunity by 2024. Under this dynamic context, the material sector will represent more than one-third of the power module market.

Yole’s report looks closely at substrates, baseplates, die-attach, substrate attach, encapsulation, interconnections, and TIM markets.

In 2018 the largest packaging material segment was baseplates, followed by substrates. The other 32 percent was represented by die-attach and substrate-attach materials. Thus, major technological choices in these segments can rapidly impact the overall power module packaging market. For example, the market share for silver sintering as a die-attach is increasing, driven especially by EV/HEV. This technology is pricier than more conventional soldering materials, and CAGR for the die-attach market is +10.8 percent between 2018 and 2024 – well higher than for other market segments.

The second-highest growth is for interconnections. Yole’s analysts announce 8.7 percent CAGR for the 2018 – 2024 period. This market segment is followed by substrates, with a 2018 – 2024 CAGR of 8.5 percent.

System Plus Consulting, sister company of Yole also collaborates with Yole’s analysts to identify and compare the current power module packaging technologies. Its report, Automotive Power Module Packaging Comparison, confronts structures and costs of solutions today delivered by key automotive suppliers. System Plus Consulting’ analysts point out the different technical choices selected by these companies.

“EV/HEVs progress pushes the electronic systems to meet new requirements to improve performance and reliability”, asserts Elena Barbarini, head of department devices at System Plus Consulting. “Since the early stages of car electrification, power modules have been playing a key role, especially in the optimisation of performances from inverters to bi-directional converters.”

Packaging these modules is today critical due to several technical aspects such as thermal efficiency and system integration. In addition, cost impact on the final solution becomes more and more stringent and lot of power electronics companies meets some issues to remain competitive in the open market.

Barbarini adds: “Power electronics companies offer various innovative solutions, from integrated heatsink to die attach, for both discretes and modules. Moreover the request of cost saving during the integration steps pushes design companies to move forward single and more flexible structures, such as 1-in-1commutation cells or embedded discretes.”

As a direct consequence, the power module packaging supply chain is showing strong changes. Indeed, two main factors will impact its reshaping in the coming years. Yole announces, the evolution of packaging technologies, and the EV/HEV industry’s specific requirements:

The evolution of packaging technologies such aslow-inductance interconnections, silver-sintering die-attach material, Si3N4 AMB ceramic substrates, will benefit the suppliers offering these solutions. For example: MacDermid Alpha, Rogers, and Toshiba Materials.

Besides the materials suppliers, packaging equipment manufacturers (i.e. wire bonders, sintering machines, reflow ovens, cleaning equipment) will also be positively or negatively impacted by these changes. The power module makers that adopt innovative packaging solutions early on can secure a better market position, as seen in the example of STMicroelectronics’ SiC power module used in the Tesla Model 3’s main inverter.

Yole says that suppliers of packaging solutions for EV/HEV power modules must adapt their strategy, product portfolio, and manufacturing capacities to satisfy strong requirements in terms of costs, manufactured volume, and product reliability.

This is a very challenging task, especially because many players are targeting opportunities offered via rapidly-growing EV/HEV demand. To succeed in this competitive environment, new mergers and acquisitions as well as partnerships are necessary to help capture new technologies/new customers quickly, and increase production capacity. To reduce cost pressure, some companies have already moved or are planning to move at least part of their production capacity to countries with lower production costs (i.e. China, Romania, and Vietnam).